Understanding and minimising customer churn is crucial for sustaining growth and profitability. This comprehensive guide will describe what is a churn analysis, its significance, and how it can be effectively conducted. We’ll also explore how online CX platforms can play a pivotal role in identifying potential churners and enhancing customer retention strategies. Let’s dive in!

What Is Churn Analysis?

Churn analysis (sometimes also called customer attrition analysis) is a strategic method businesses employ to determine the rate at which customers end their relationship with them within a given timeframe. This approach delves into understanding why customers choose to leave, focusing on analysing CX feedback, customer behaviour, purchase history, and engagement levels to uncover patterns or indicators of churn.

Customer churn analysis specifically targets the loss of customers, enabling you to identify potential reasons behind customer attrition. By conducting this comprehensive analysis, you can devise and implement effective strategies aimed at enhancing customer retention and minimising the rate of customer loss.

Why Churn Analysis Is Important

Churn analysis is not just about identifying lost customers; it’s about understanding the ‘why’ behind the numbers. Understanding and reducing customer churn is critical for several reasons:

- Financial health: Acquiring new customers is often more costly than retaining existing ones. Reducing churn directly impacts a company’s bottom line.

- Customer lifetime value (CLV): Minimising churn increases the lifetime value of customers, enhancing overall revenue.

- Customer experience: Improving customer experience by addressing the root causes of dissatisfaction.

- Customer loyalty: Addressing the root causes of churn and closing the loop with at-risk customers aids in building customer loyalty.

- Product and service improvement: Churn analysis provides insights into potential areas of improvement in products or services.

- Competitive advantage: Companies that excel in retaining customers often have a competitive edge in saturated markets.

Now that you understand the reasons why use churn analysis, let’s explore how it is carried out.

Retain Customers and Increase Profits!

Make sure your customer relationships don't slip away with Staffino's Retention Case Monitoring. This easy-to-use tool gives you the power to maximise customer retention and boost loyalty.

How to Do Churn Analysis

Let’s now explore how to do customer churn analysis:

1. Data Collection

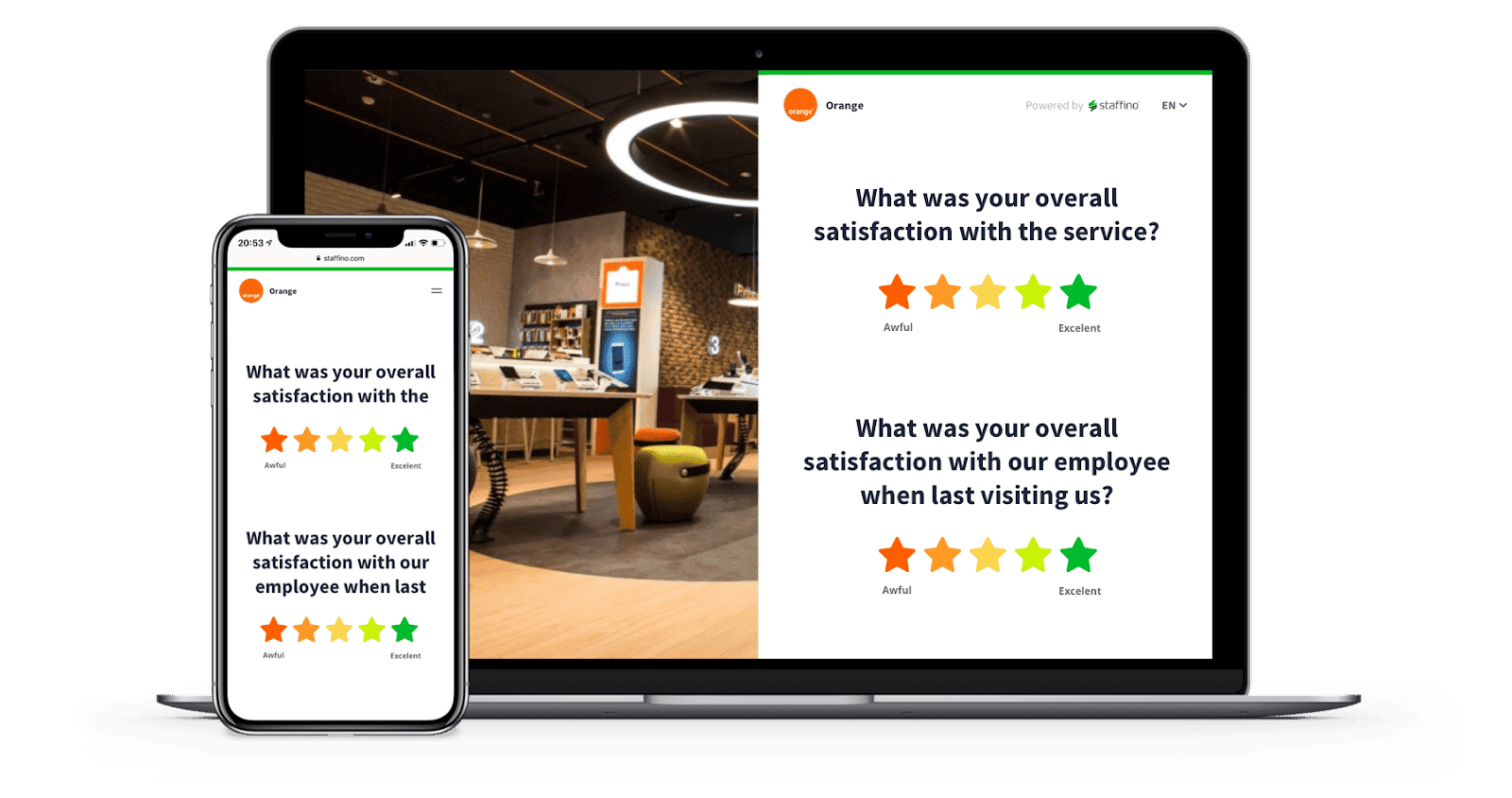

The foundation of any churn analysis is robust data collection. This involves gathering data across multiple touchpoints, such as in-store purchases, customer service interactions, or online engagements. It’s important to collect both quantitative data (e.g., purchase frequency, average spend) and qualitative data (e.g., customer feedback, customer satisfaction survey).

In retail, integrating data from loyalty programs can also provide insights into customer behaviour and preferences. Ensuring data quality and completeness at this stage is critical for the accuracy of the analysis.

Get the Most Out of Customer Feedback with Mastery Shopping®

Stop relying on one mystery shopper and get real feedback from the people who matter most – your customers. Discover what’s really going on in your business and start making smarter decisions today.

2. Define Churn

Churn can be defined differently depending on the context. Let’s give you an example. For a pharmacy, churn might mean a customer who has not refilled a prescription for a chronic condition within a specific period or someone who has stopped purchasing wellness products regularly. It’s essential to establish clear criteria that reflect meaningful loss of business. This definition can include both direct indicators (e.g., no purchases in 6 months) and indirect indicators (e.g., significant reduction in engagement levels). A precise definition helps in accurately identifying at-risk customers and tailoring interventions.

3. Customer Segmentation

Segmenting customers allows you to identify specific groups that are more likely to churn. Segmentation can be based on demographic factors (age, gender, location), behavioural factors (purchase patterns, product preferences), or value-based factors (high-value vs. low-value customers). Advanced segmentation might also consider lifestyle choices. Understanding each segment’s characteristics can help identify why certain groups are more prone to churn and tailor customer retention management strategies accordingly.

4. Predictive Modeling

With the advancements in data analytics, you can use statistical models and machine learning algorithms to predict which customers are at risk of churning.

Techniques such as AI churn prediction, logistic regression, decision trees, and neural networks can be employed to analyse historical data and identify patterns that precede churn. These models can take into account a wide range of variables, from transaction history to interaction logs, providing a predictive score for each customer’s likelihood to churn. Continuously refining these models with new data helps improve their accuracy over time.

5. Insight Generation

The analysis must then be translated into actionable insights. This involves understanding not just who is likely to churn but why. The reasons might include dissatisfaction with service, better pricing elsewhere, or changes in customer needs. It’s important to drill down into the data to identify specific issues and opportunities for improvement.

Qualitative (open-text) feedback from customers can be particularly valuable here, providing context that quantitative data alone cannot.

6. Strategy Implementation

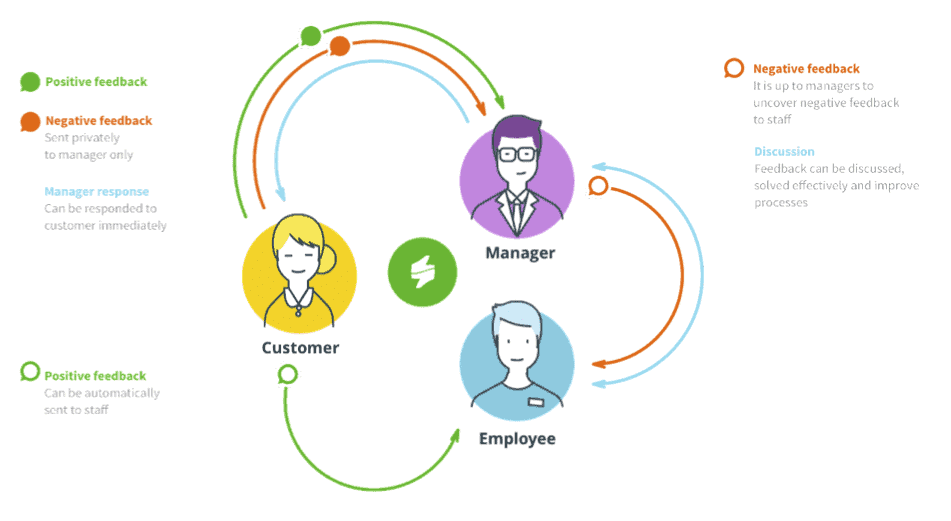

Based on the insights gathered, you can develop targeted strategies to reduce churn. This might include a closed loop feedback system, personalised communication campaigns, loyalty programs, service improvements, or targeted offers.

For example, customers identified as at risk due to price sensitivity could be offered discounts or enrolled in a savings program. Implementing these strategies requires coordination across different parts of the organisation, from marketing to operations. Monitoring the impact of these strategies on customer retention is crucial, allowing for adjustments based on what is most effective.

7. Monitoring and Continuous Improvement

Finally, churn analysis is not a one-time activity but an ongoing process. Continuous monitoring of customer behaviour and feedback, along with regular updates to predictive models, helps you stay ahead of potential churn risks. Regularly revisiting and refining the strategies implemented based on new data and insights ensures that retention efforts remain effective over time.

The Benefits of Using a CX Platform for Customer Churn Analytics

Using a customer experience platform like Staffino for churn analytics can profoundly transform how you understand and manage customer retention. This is how:

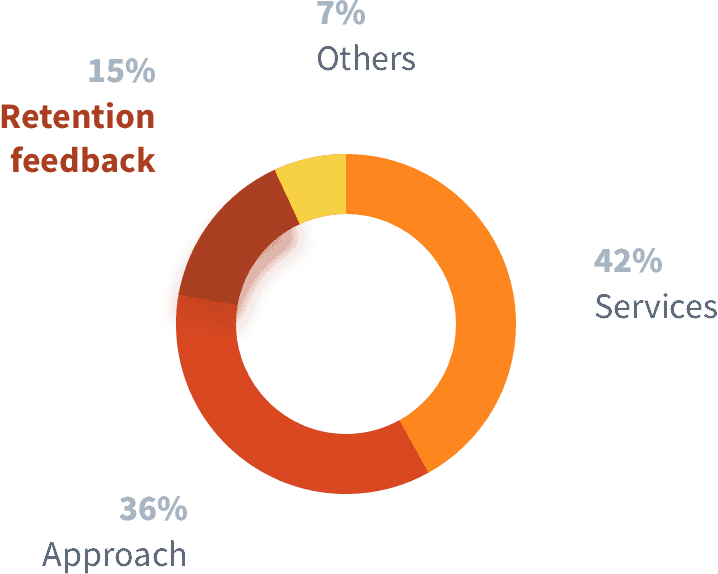

1. Identification and Flagging of Potential Churners through AI Analytics

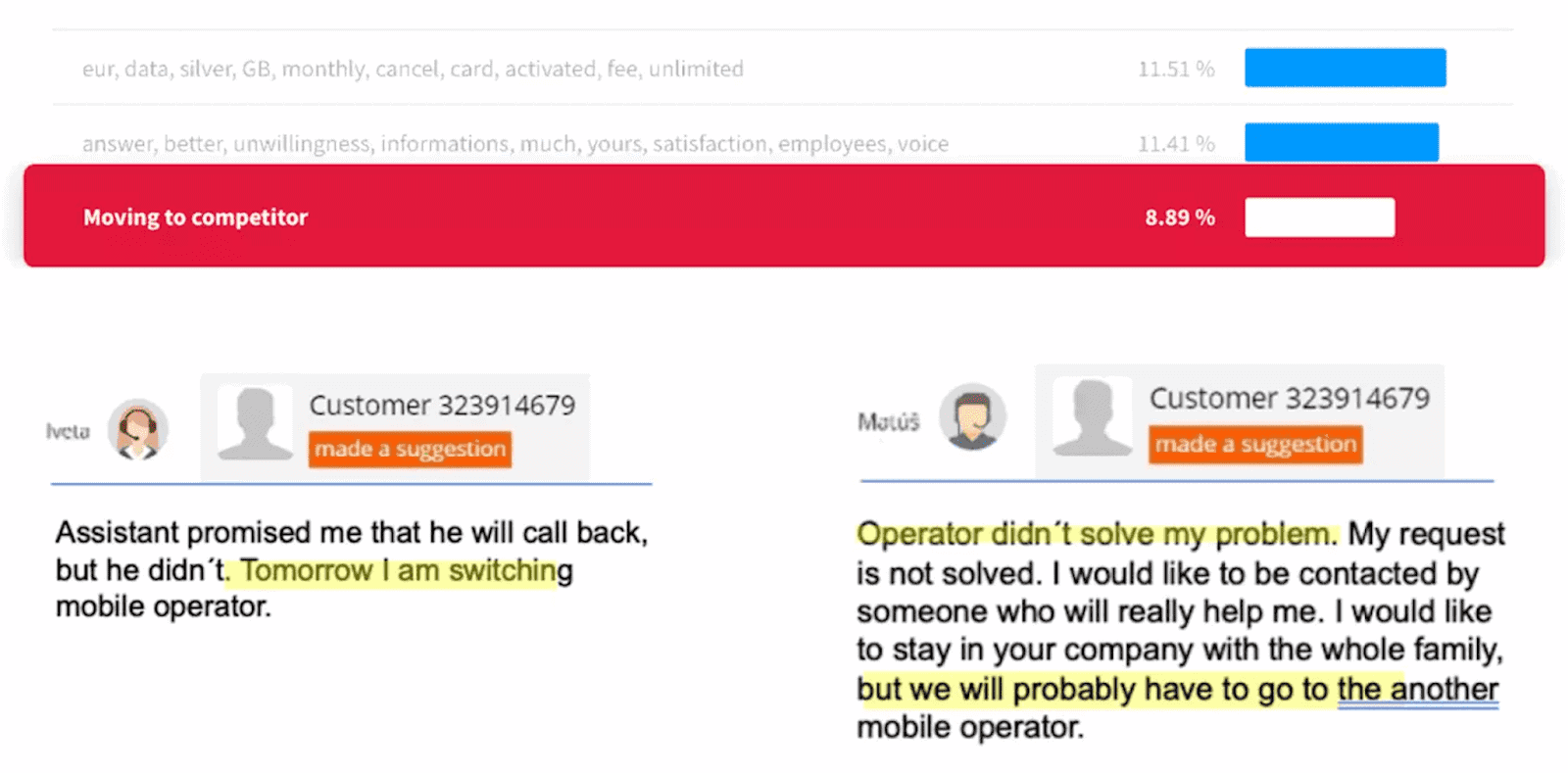

This process involves a sophisticated AI-driven customer churn model that sifts through customer feedback data to pinpoint customers who exhibit behaviours indicative of a high risk of leaving. Upon identification, these customers are immediately marked as “at-risk” within our system, triggering a notification to the relevant manager or team members. This prompt notification enables them to take the appropriate actions to retain the customer.

The customer churn model can accurately forecast which customers are likely to churn by analysing patterns in customer interactions, purchase history, and engagement levels. This preemptive identification is crucial for timely intervention, allowing you to your retention efforts on the right segment of your customer base.

2. Implementation of a Closed-Loop Feedback System to Address Customer Concerns Promptly

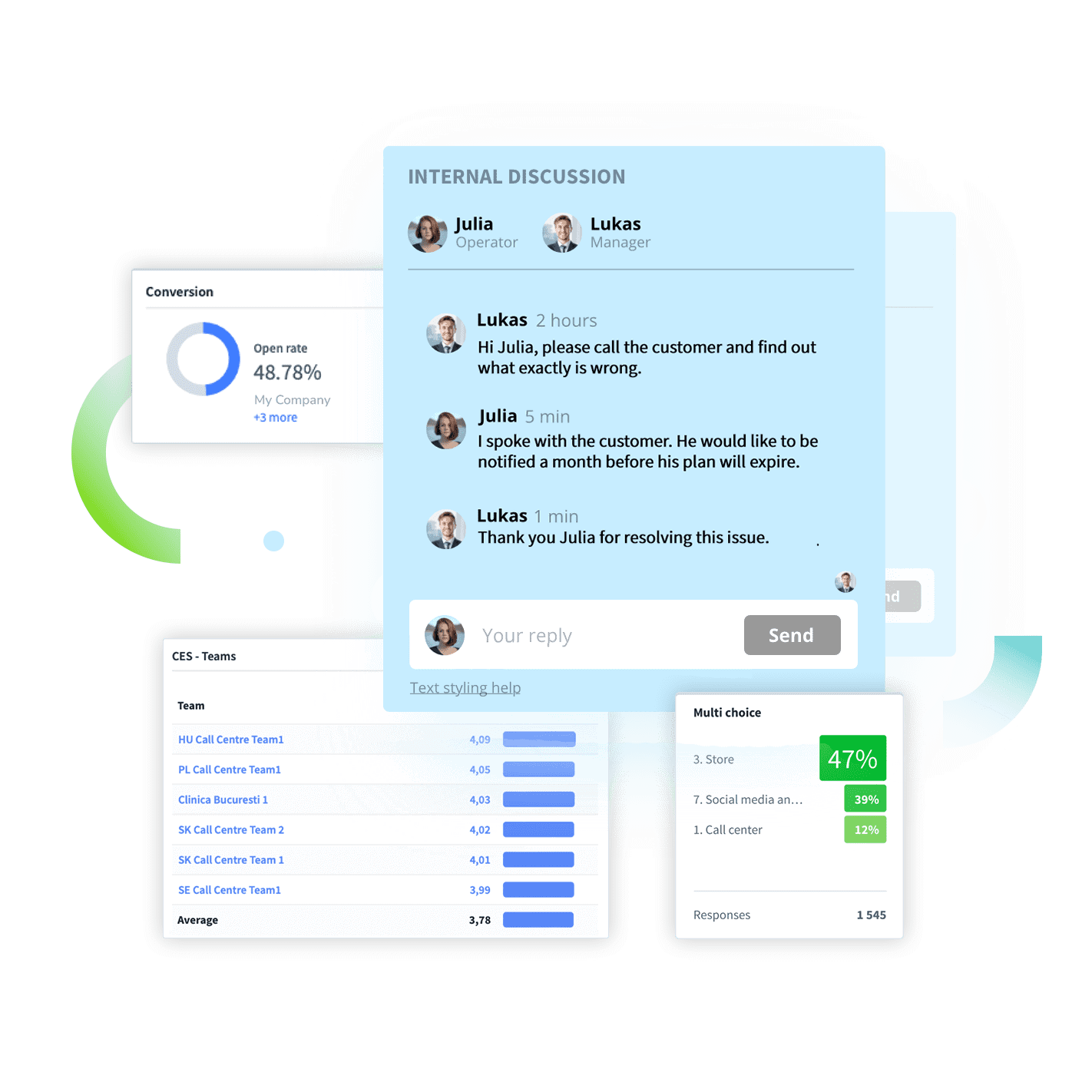

Once potential churners are identified, Staffino facilitates the feedback loop system. If you’re not familiar with the feedback loop meaning, this system is a necessity for addressing customer concerns promptly and effectively.

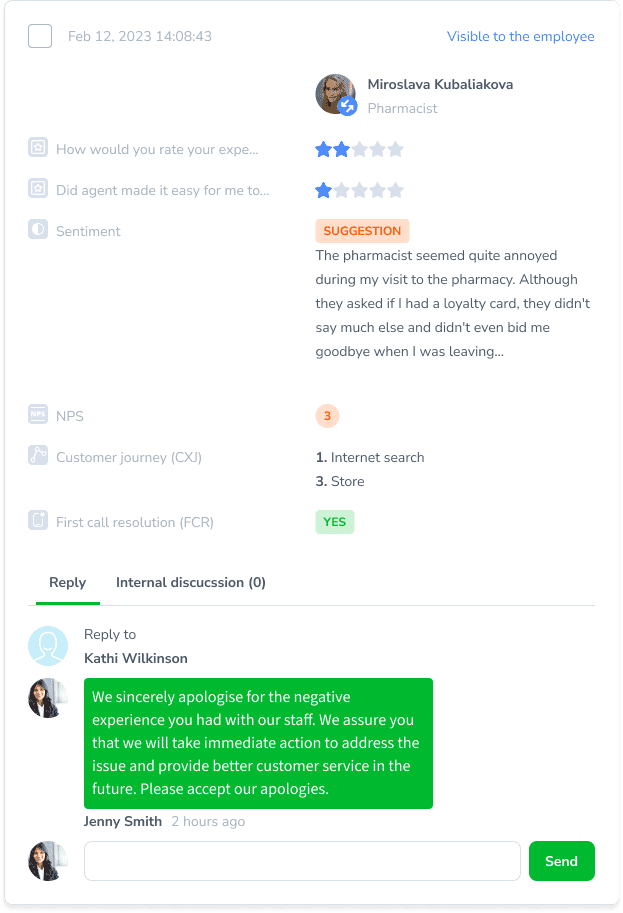

A closed-loop feedback system ensures that customer feedback and concerns are not only heard but are acted upon. Managers receive real-time notifications about potential churn cases and can directly respond to the customer via a chat thread linked to their feedback.

They can also engage employees in the conversation for internal discussion (invisible to the customer), allowing them to gather insights on the situation and offer the customer a satisfactory resolution.

When a customer issue is reported, the system tracks the issue from the initial complaint through to resolution, ensuring that no customer feedback falls through the cracks. This process of closing the loop enhances customer satisfaction and prevents churn by demonstrating that the company values their input and is committed to resolving their concerns.

3. Turning Customer Insights into Actionable Retention Strategies

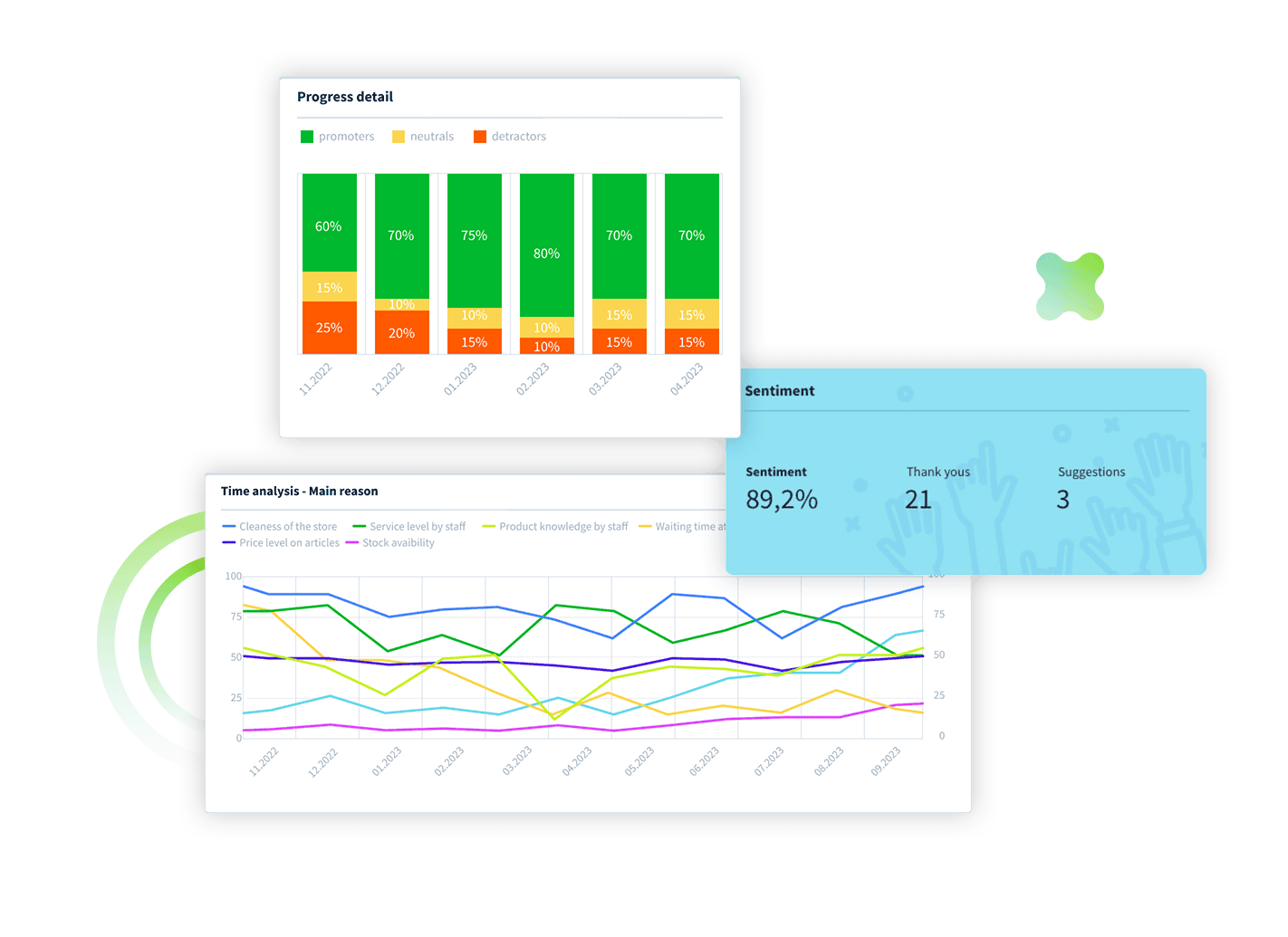

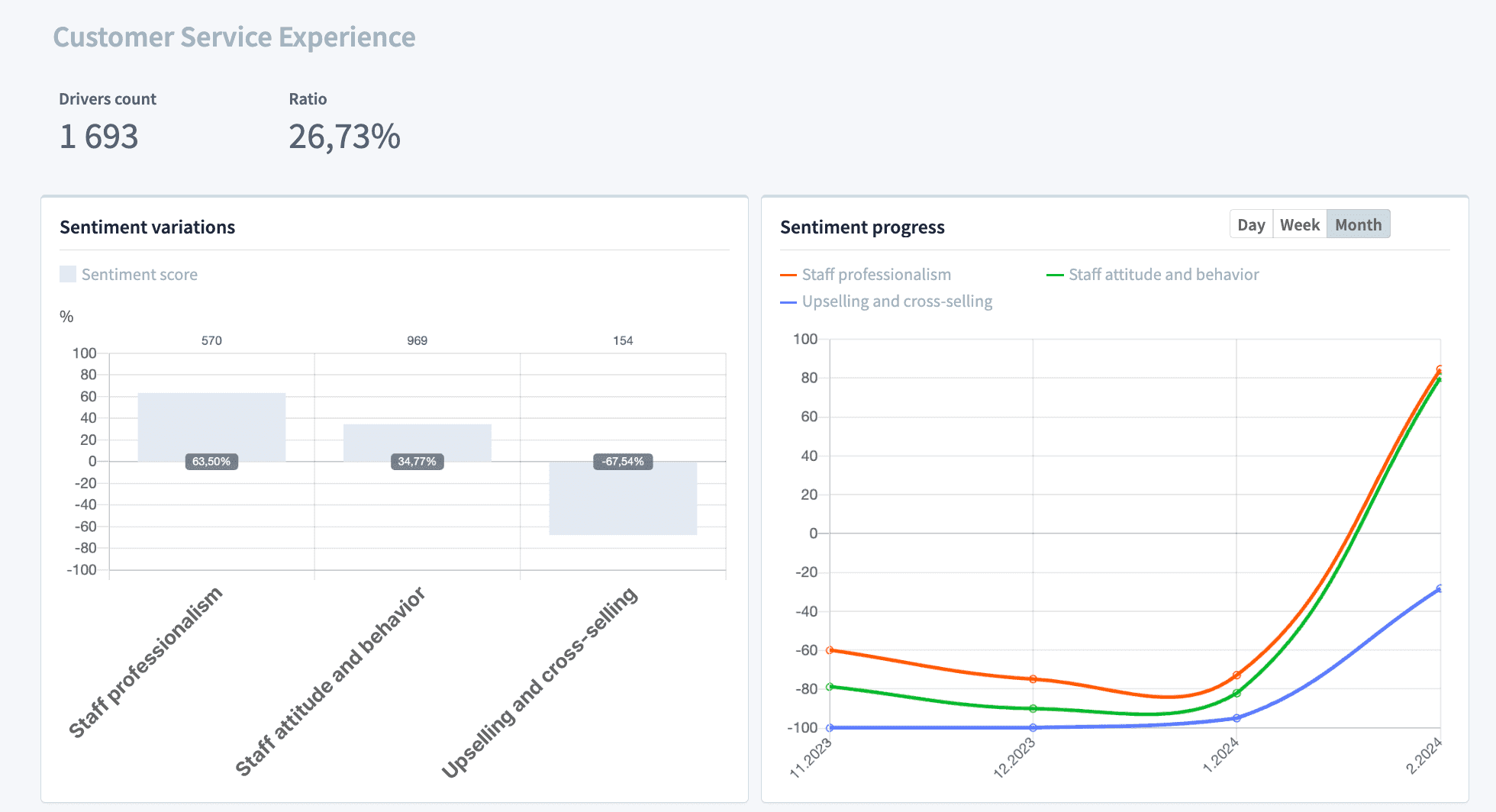

The final step involves turning customer insights into actionable retention strategies. This step goes beyond merely addressing individual customer issues; it involves a comprehensive churn rate analysis or client churn analysis to understand broader patterns and trends in customer behaviour.

By analysing churn test results on Staffino’s CX dashboards, you can quickly identify common factors leading to customer dissatisfaction. With this knowledge, you can implement targeted retention strategies addressing these underlying issues. For example, if churn analysis reveals that customers are leaving due to perceived value, the company might introduce loyalty programs or personalised offers to enhance perceived value. This strategic approach to retention, informed by churn analytics, ensures that you are not only responding to individual feedback but are also proactively addressing systemic issues that contribute to churn.

How Companies Benefit from Churn Data Analysis

Let’s explore a practical application of our churn analysis through a case study with our client, the renowned telecommunications company Orange. By leveraging our churn prediction analysis, Orange was able to successfully retain a substantial portion of their at-risk customers, resulting in significant financial savings. The total amount saved, thanks to our predictive analytics, amounted to nearly €200,000.

“Thanks to the simplicity of the Staffino platform and the ability to internally discuss each case directly within the app, we’ve been able to retain 70% of customers who were likely to leave.”

Vladislav kupka

BOARD MEMBER, ORANGE SLOVAKIA

This case study exemplifies the tangible benefits of our churn analysis in the telecommunications sector, showcasing our ability to deliver substantial value to our clients.

Closing Thoughts

By understanding the nuances of customer churn analysis and employing sophisticated tools to conduct it, you can not only reduce customer attrition but also enhance overall customer satisfaction and loyalty. Remember, the goal of churn analysis is not just to measure the rate of loss but to understand the reasons behind it and to implement effective strategies to keep your customers engaged and loyal for the long haul.

Get a First-Hand Experience Today!

Staffino is the perfect tool for creating engaging surveys, tracking performance, responding to customer feedback, and rewarding top employees. Get started today with our FREE demo!