In today’s competitive business landscape, delivering a top-notch customer experience (CX) is essential, but where do you start?

As the saying goes, “the customer is king,” and understanding their needs, preferences, and satisfaction levels is crucial for long-term success. This is where customer experience surveys come into play, providing valuable insights into the customer journey and helping you make data-driven decisions to enhance your offerings.

When crafting a customer experience survey, the ultimate goal is to improve customer satisfaction, foster enthusiastic participation, and ultimately drive business success. This comprehensive guide delves into the art of designing an exceptional customer experience survey, covering various survey types, highlighting their significance, offering best practices, and presenting essential customer satisfaction survey questions that should not be overlooked.

What Is a CX Survey?

A CX survey is a systematic approach to collecting feedback from customers about their experience with a company’s products, services, or interactions. It is a valuable tool that allows organisations to measure customer satisfaction, identify areas for improvement, and gauge overall brand perception. By gathering quantitative and qualitative data, CX surveys provide actionable insights that help businesses improve customer experience strategies.

What Is a Consumer Survey?

A consumer survey, on the other hand, is a broader term that encompasses a wide range of surveys aimed at understanding consumer behaviour, preferences, and opinions. While CX surveys focus specifically on the customer experience, consumer surveys may cover various aspects such as market research, product development, and customer demographics. Customer experience surveys can be considered a subset of consumer surveys, concentrating on the customer journey and satisfaction.

What Is CX Research?

CX research refers to the systematic study of customer experiences, behaviours, and interactions with a company. It involves gathering and analysing data from various sources, including CX surveys, to gain a comprehensive understanding of the customer journey. CX research helps organisations uncover patterns, identify pain points, and develop strategies to improve customer satisfaction and loyalty.

What Are the 4 Types of Customer Satisfaction Surveys?

Let’s now look at the four most common types of customer experience surveys:

1. Transactional Surveys

These surveys capture feedback immediately after a specific customer interaction, such as a purchase, support call, or website visit. They focus on measuring satisfaction with the transaction itself and provide real-time insights into the customer experience.

2. Relationship Surveys

Relationship surveys aim to gauge overall customer satisfaction and loyalty over a more extended period. They typically involve regular check-ins to understand the customer’s perception of your brand, their likelihood to recommend, and their overall satisfaction.

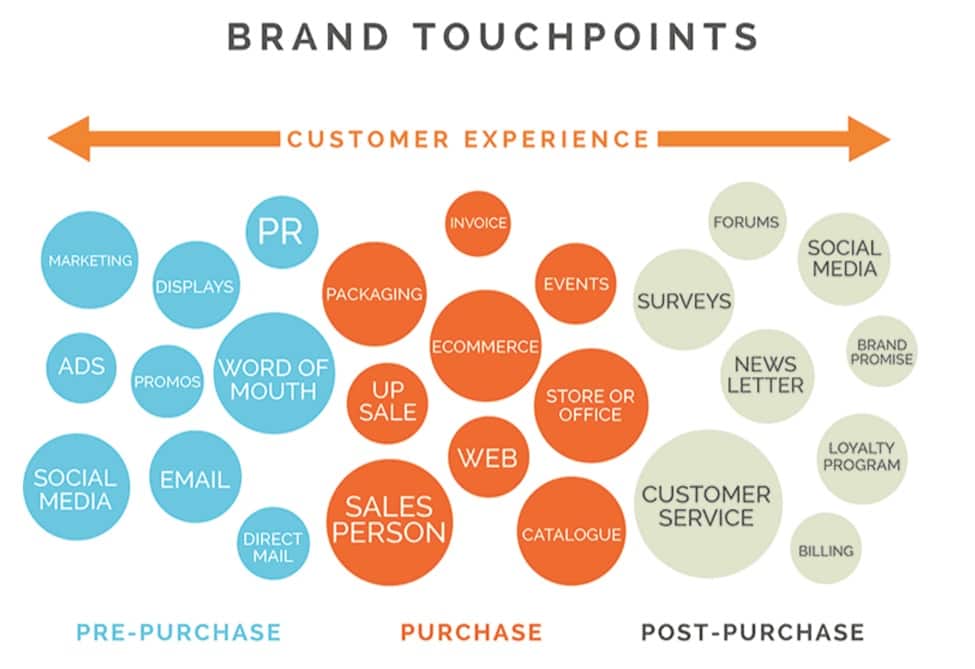

3. Touchpoint Surveys

Touchpoint surveys focus on specific touchpoints throughout the customer journey, such as website navigation, onboarding process, or customer service interactions. They help identify strengths and weaknesses at each touchpoint, allowing you to ensure a great experience at critical stages.

4. Brand Perception Surveys

These surveys assess customers’ perception of a brand, including its reputation, values, and positioning in the market. Brand perception surveys provide insights into how customers view your company as a whole, helping you align your branding strategies with customer expectations.

Why Are Customer Surveys Important?

Customer surveys should play a pivotal role in your company’s experience management (XM) initiatives. Here are some key reasons why they are important:

1. Measure Customer Satisfaction

Surveys allow you to quantitatively measure customer satisfaction levels and identify areas for improvement. By tracking satisfaction over time, you can gauge the effectiveness of your customer experience initiatives.

2. Identify Pain Points

Surveys help uncover pain points in the customer journey, enabling you to address issues and enhance the overall experience. By proactively resolving customer concerns, you can foster customer loyalty and improve customer retention management.

3. Enhance Product Development

Customer feedback surveys provide valuable insights for product development. Understanding customer preferences, needs, and expectations helps your product team create offerings that align with customer demands.

4. Build Customer Loyalty

By actively seeking customer feedback and acting upon it, you demonstrate your commitment to customer satisfaction. This, in turn, fosters loyalty and encourages customers to become your brand advocates.

5. Increase Revenue

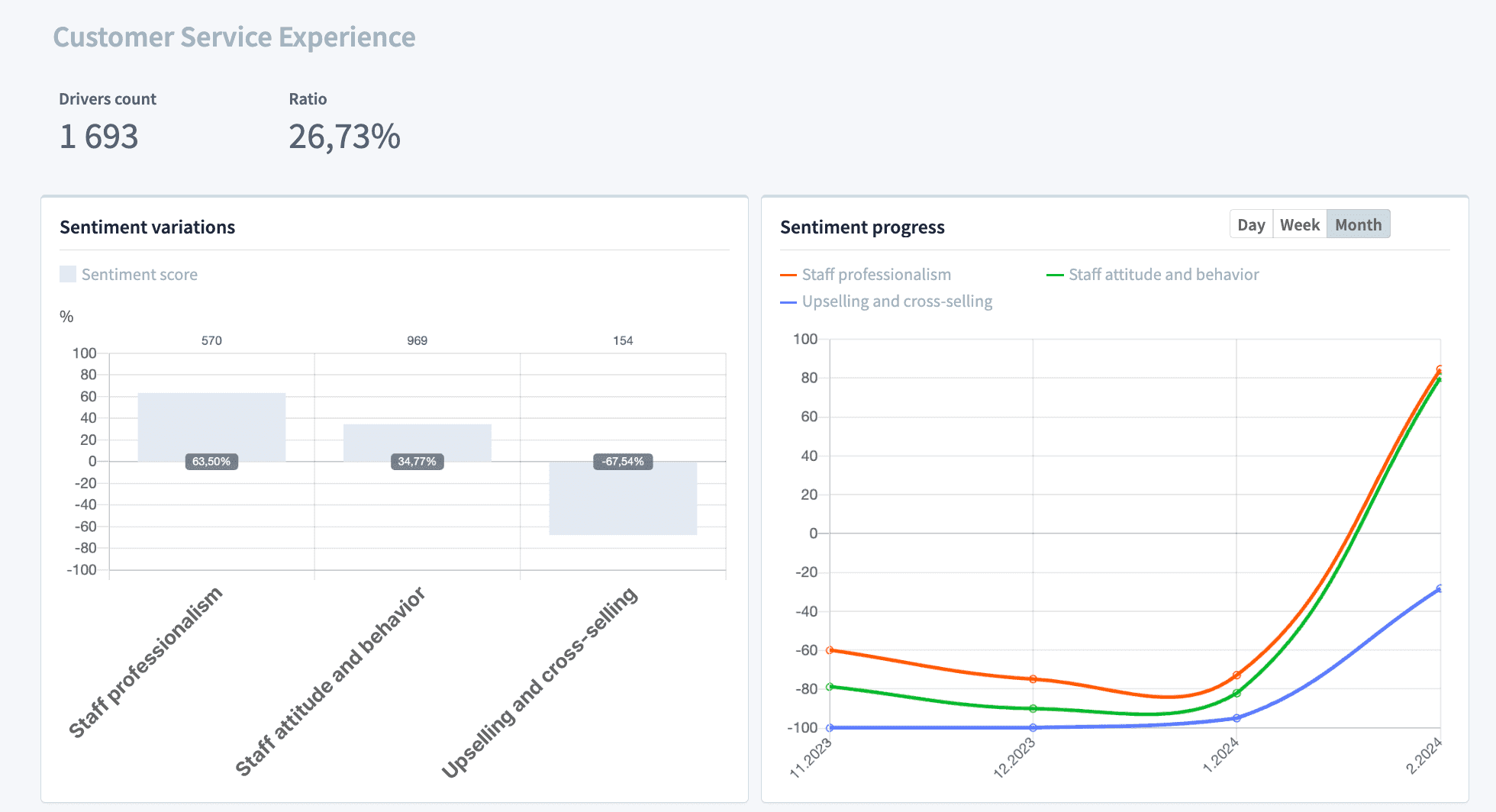

Customer experience surveys can help identify upsell and cross-sell opportunities, allowing you to increase your revenue. By understanding customer needs and preferences, you can tailor your offerings and target customers who are ready for upselling or cross-selling. This can lead to a significant increase in incremental revenue, as demonstrated in this CX case study conducted with Dr.Max, a leading European pharmacy chain.

Are Customer Surveys Effective? Best Practices for Ensuring Their Effectiveness

A customer feedback survey can be highly effective when designed and implemented correctly. However, their effectiveness depends on several factors, including survey design, timing, and the organisation’s ability to act upon the feedback received. To ensure effectiveness, businesses should consider the following best practices:

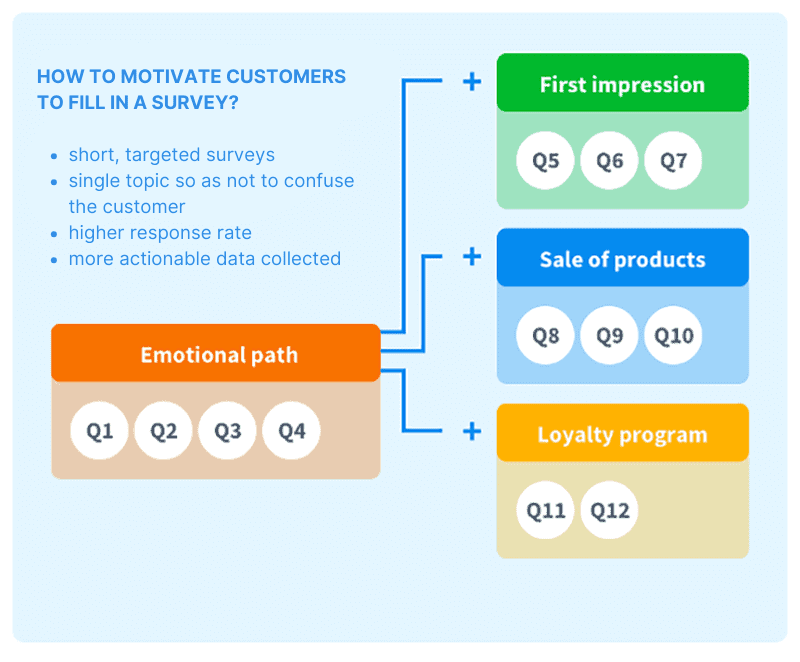

1. Keep Surveys Short and Focused

Long surveys can lead to survey fatigue and lower response rates. Keeping surveys concise and focused on specific objectives increases the likelihood of receiving meaningful feedback.

2. Use a Mix of Rating Scales and Open-Ended Questions

Combining rating scales with open-ended questions allows customers to provide both quantitative and qualitative feedback. This provides a more comprehensive understanding of their experiences.

3. Offer Incentives

To encourage participation, consider offering incentives such as discounts, gift cards, or exclusive access to promotions. Incentives can increase response rates and improve the quality of feedback received.

4. Act on Feedback

Gathering feedback is only the first step; acting upon it is equally important. Your organisation should have a robust system in place to analyse survey results, identify trends, and implement necessary changes to improve the customer experience.

Top 8 Customer Experience Metrics to Include in Your CX Survey

Having the right metrics included in your client satisfaction survey is crucial. These metrics provide valuable insights into how your customers perceive your product, service, or website and can help you identify areas for improvement. Let’s now look at the top eight customer experience metrics that you should include in your CX survey:

Boost Customer Experience with NPS, CSAT & CES

Get the most accurate and actionable insights into your customer satisfaction with Staffino's CX metrics. With automated surveys and effective reporting, you can quickly gain valuable insights into your customer journey.

1. Customer satisfaction score (CSAT)

The CSAT metric measures customer satisfaction with your product, website, employee or service. It allows users to rate their overall satisfaction on a scale of 1-5. By tracking CSAT scores over time, you can gauge how satisfied your customers are and identify any trends or patterns that may impact their satisfaction levels.

2. Customer effort score (CES)

The CES metric measures the amount of effort a customer has to exert to perform a specific action, such as making a purchase or resolving an issue. It is rated on a scale from very difficult to very easy. By monitoring CES, you can identify areas where customers are facing excessive effort and take steps to streamline their experience.

3. Net Promoter Score (NPS)

The NPS metric is widely used to measure customer loyalty and satisfaction. It involves asking customers how likely they are to recommend your product or service to others on a scale of 0 to 10. By categorising customers into promoters, passives, and detractors based on their responses, you can gain insights into their loyalty and identify opportunities for improvement.

- Promoters: Customers who respond with a score of 9 or 10 are considered promoters. These individuals are highly satisfied and loyal to the brand. They are likely to recommend the product or service to others and can be seen as brand advocates. Promoters play a crucial role in spreading positive word-of-mouth and driving new customer acquisition.

- Passives: Customers who respond with a score of 7 or 8 are classified as passives. They are generally satisfied with the product or service but are not as enthusiastic as promoters. Passives are considered neutral and may not actively recommend or criticise the brand. While they may continue using the product or service, they are more susceptible to switching to a competitor if a better offer or experience comes along.

- Detractors: Customers who respond with a score of 0 to 6 are detractors. These individuals are dissatisfied and unhappy with their experience. They are more likely to spread negative word-of-mouth and can harm the brand’s reputation. Detractors are at a higher risk of churning and seeking alternatives. Identifying and addressing the concerns of detractors is crucial to improving customer satisfaction and loyalty.

To calculate the Net Promoter Score, the percentage of detractors is subtracted from the percentage of promoters. The resulting score ranges from -100 to +100, providing an overall measure of customer loyalty and satisfaction. You can use this metric to track your performance over time, benchmark against competitors, and identify areas for improvement.

4. Customer churn and retention rate

Churn measures the percentage of customers who stop subscribing to or buying products from your company. On the other hand, retention measures your business’s ability to keep its customers over time. By tracking these metrics, you can identify factors that contribute to customer attrition and take proactive measures to improve customer retention.

Retain Customers and Increase Profits!

Make sure your customer relationships don't slip away with Staffino's Retention Case Monitoring. This easy-to-use tool gives you the power to maximise customer retention and boost loyalty.

5. First Call Resolution (FCR)

The FCR metric measures the percentage of customer issues or inquiries that are resolved during the first interaction with customer support. A high FCR indicates that your support teams are able to effectively address customer concerns without the need for multiple contacts. By tracking FCR, you can identify areas where additional training or process improvements may be needed to increase first-call resolution rates.

6. First response time (FRT)

The FRT metric measures the average time it takes your customer support teams to respond to a customer issue or request. A prompt response is crucial in providing a positive customer experience. By monitoring FRT, you can ensure that your support teams are addressing customer concerns in a timely manner.

7. Average resolution time (ART)

The ART metric measures the average time it takes your customer success team to successfully resolve each customer support request. Customers expect quick and effective solutions to their problems. By tracking ART, you can identify bottlenecks in your support process and implement strategies to improve resolution times.

8. Customer lifetime value (CLTV or LTV)

The CLTV metric is a revenue-focused metric that measures the average revenue a customer is expected to bring to your company over time. By understanding the value of each customer, you can make informed decisions regarding customer acquisition, retention, and loyalty programs.

Numbers Ain’t Everything: The Power of Open-Ended Questions in a CX Survey

Unfortunately, many companies rely heavily on numerical ratings and quantitative data to gather customer feedback. While these metrics can provide valuable insights into customer satisfaction, they often fail to capture the full picture. This is where the power of open-ended questions in a CX survey comes into play.

In a CX survey, open-ended questions can uncover valuable information that may not be captured through numerical ratings alone. Furthermore, open-ended questions can uncover unexpected insights and ideas. Customers may offer suggestions or highlight opportunities for innovation that the company may not have considered.

However, it’s important to note that analysing open-ended responses can be more time-consuming and complex compared to numerical data. We recommend investing in effective text analytics tools like our AI customer feedback analysis to extract meaningful insights from these responses. Nonetheless, the effort is well worth it, as the qualitative data gathered from open-ended questions can provide a richer and more holistic understanding of the customer experience.

Customer Satisfaction Survey Questions That Are a Must-Have for the 4 Different Types of Surveys

Before we delve into specific customer feedback forms examples, let’s explore some crucial feedback questions that should be included in each of the four types of customer satisfaction surveys. When designing these customer survey questions, it’s important to consider your company’s unique requirements. While it may seem challenging, seeking guidance from CX consulting experts can help you create impactful surveys that provide actionable insights.

1. Transactional Survey Question Examples

How satisfied are you with your recent purchase/service interaction?

This question measures the customer’s satisfaction level with their recent transaction. It helps identify any issues or areas of improvement in the customer experience.

Did our team resolve your issue in a timely manner?

This question assesses the efficiency and effectiveness of the customer service team in resolving any issues or concerns. It helps gauge the customer’s perception of the support they received.

How likely are you to recommend our product/service to others?

This question is based on the Net Promoter Score (NPS) metric, which measures customer loyalty and likelihood to recommend. It provides insights into the customer’s overall satisfaction and the potential for word-of-mouth referrals.

2. Relationship Survey Question Examples

On a scale of 1-10, how satisfied are you with our overall service?

This question captures the customer’s overall satisfaction with the company’s service. It provides a general assessment of the customer’s experience and helps identify areas for improvement.

How likely are you to continue using our product/service in the future?

This question measures the customer’s loyalty and likelihood of remaining a customer. It helps gauge the customer’s intention to continue their relationship with the company.

What improvements would you like to see in our offerings?

This question allows customers to provide specific feedback on areas they believe could be improved. It helps identify opportunities for enhancing the company’s offerings and meeting customer expectations.

3. Touchpoint Survey Question Examples

How easy was it to navigate our website?

This question assesses the usability and user-friendliness of the company’s website. It helps identify any issues or challenges customers may have encountered while navigating the site.

Were you satisfied with the onboarding process?

This question measures the customer’s satisfaction with the onboarding process, which is crucial for a positive initial experience. It helps identify any areas of improvement in terms of clarity, support, and ease of onboarding.

Did our customer service team meet your expectations?

This question evaluates the customer’s satisfaction with the customer service team’s performance. It helps assess the team’s effectiveness in addressing customer needs and meeting their expectations.

4. Brand Perception Survey Question Examples

How would you describe our brand in three words?

This question captures the customer’s perception of the company’s brand. It helps identify the key attributes or characteristics associated with the brand and provides insights into the brand image.

What sets our brand apart from competitors?

This question helps identify the unique selling points or competitive advantages of the company’s brand. It provides insights into the factors that differentiate the brand from its competitors.

How likely are you to recommend our brand to others?

Similar to the NPS question in transactional surveys, this question measures the customer’s likelihood to recommend the brand. It helps assess customer loyalty and the potential for brand advocacy.

5 Powerful Customer Survey Examples from Real Brands

And now, the moment you’ve all been waiting for (or scrolling for) – we’re about to reveal real-life CX questionnaire examples from successful global and national brands across a range of industries, including retail, finance, energy, utilities, and field services. These brands have mastered the art of utilising Staffino customer experience surveys to enhance their CX strategies.

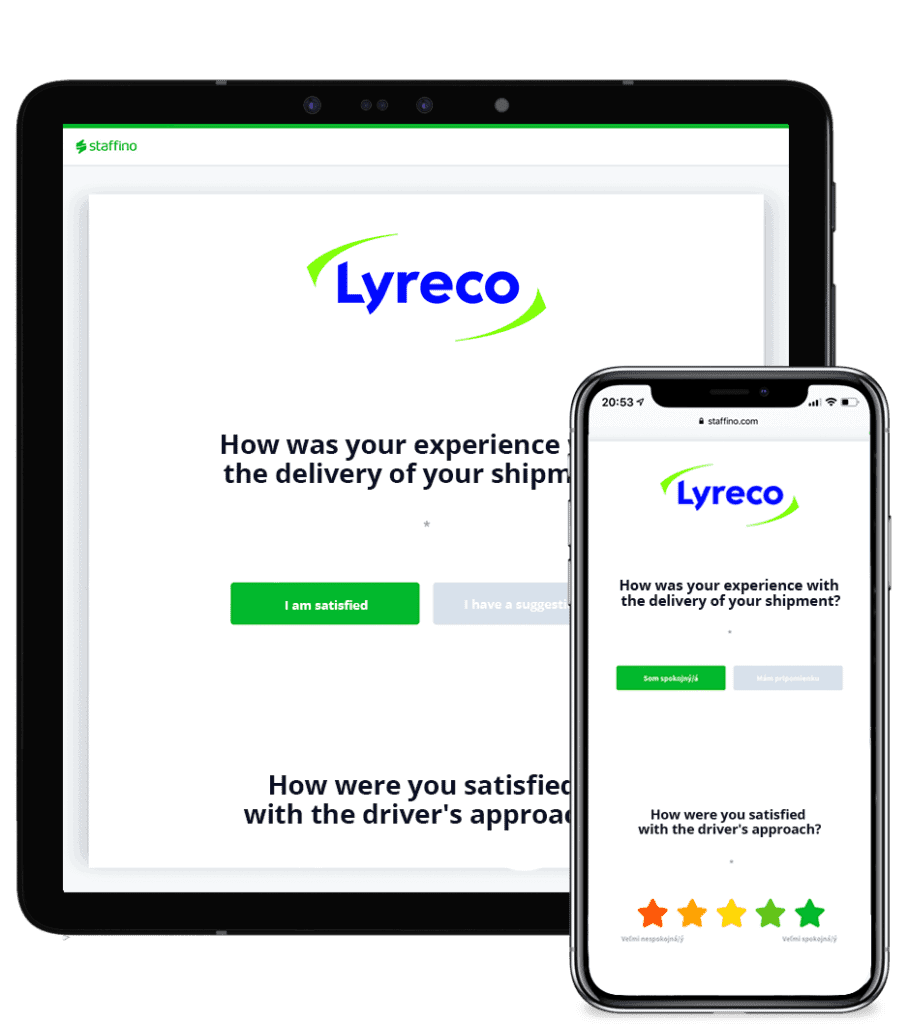

1. Lyreco: Transactional Satisfaction Survey

Lyreco is a leading provider of workplace supplies and solutions. They understand the importance of CX and utilise surveys to measure satisfaction with their delivery couriers.

By implementing a transactional satisfaction survey, Lyreco can gather feedback from customers regarding their delivery experience. This feedback allows them to identify any issues or areas for improvement, ensuring that their customers receive a seamless and satisfactory delivery service. More information about their CX feedback survey can be found on their blog, which showcases their commitment to customer excellence. Check out the results of their CX survey here.

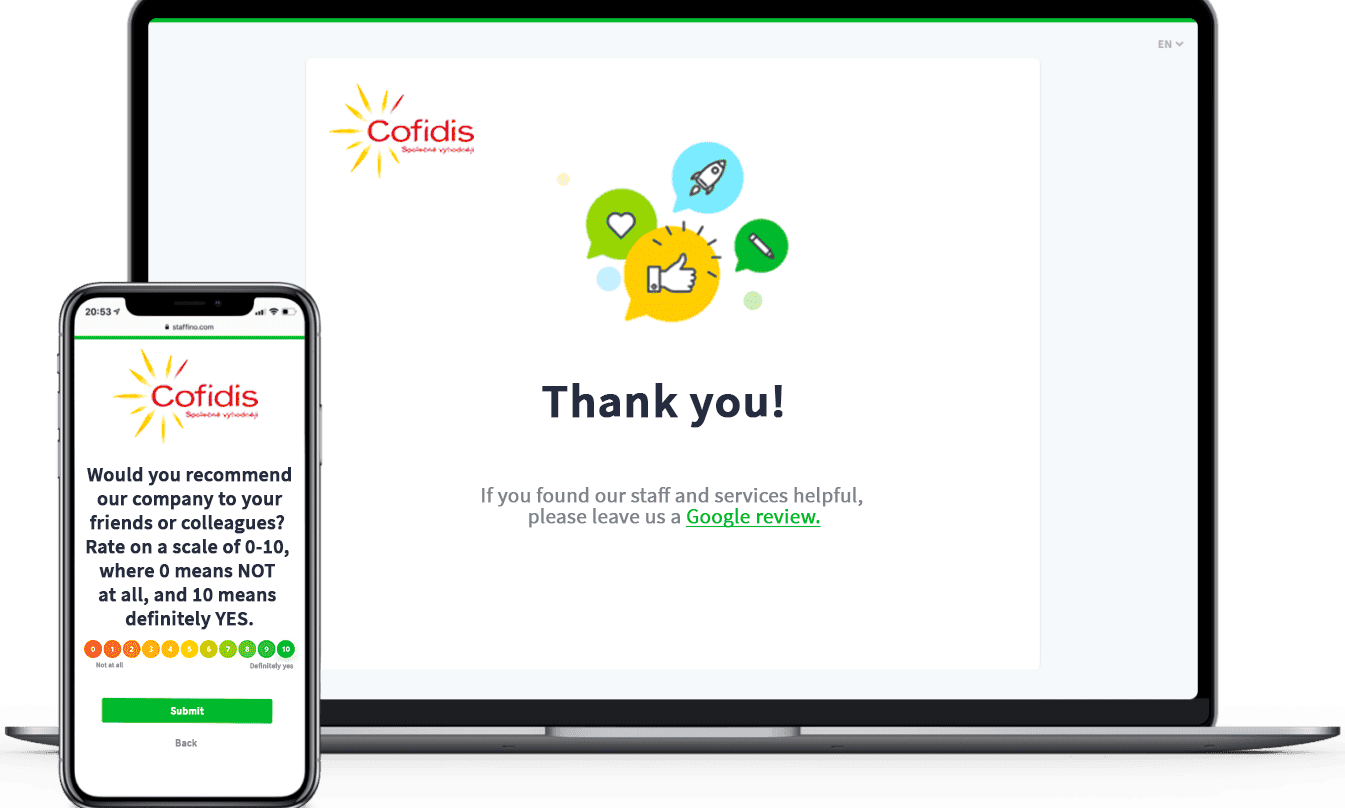

2. Cofidis: Touchpoint NPS and CSAT Survey Questionnaire

Cofidis is a financial services company specialising in consumer credit. As you can see in this customer feedback form sample, they prioritise CX by implementing touchpoint NPS and CSAT surveys to measure customer sentiment after contact centre interactions.

These surveys help Cofidis gauge customer satisfaction levels and identify areas where they can improve their contact centre services. By gathering feedback directly from customers, Cofidis made many data-driven decisions to enhance their customer support processes and ensure a positive customer experience. As a result, they successfully reduced detractors by 5.9% within a span of one year, accompanied by a notable year-over-year increase of 15 percentage points in their NPS.

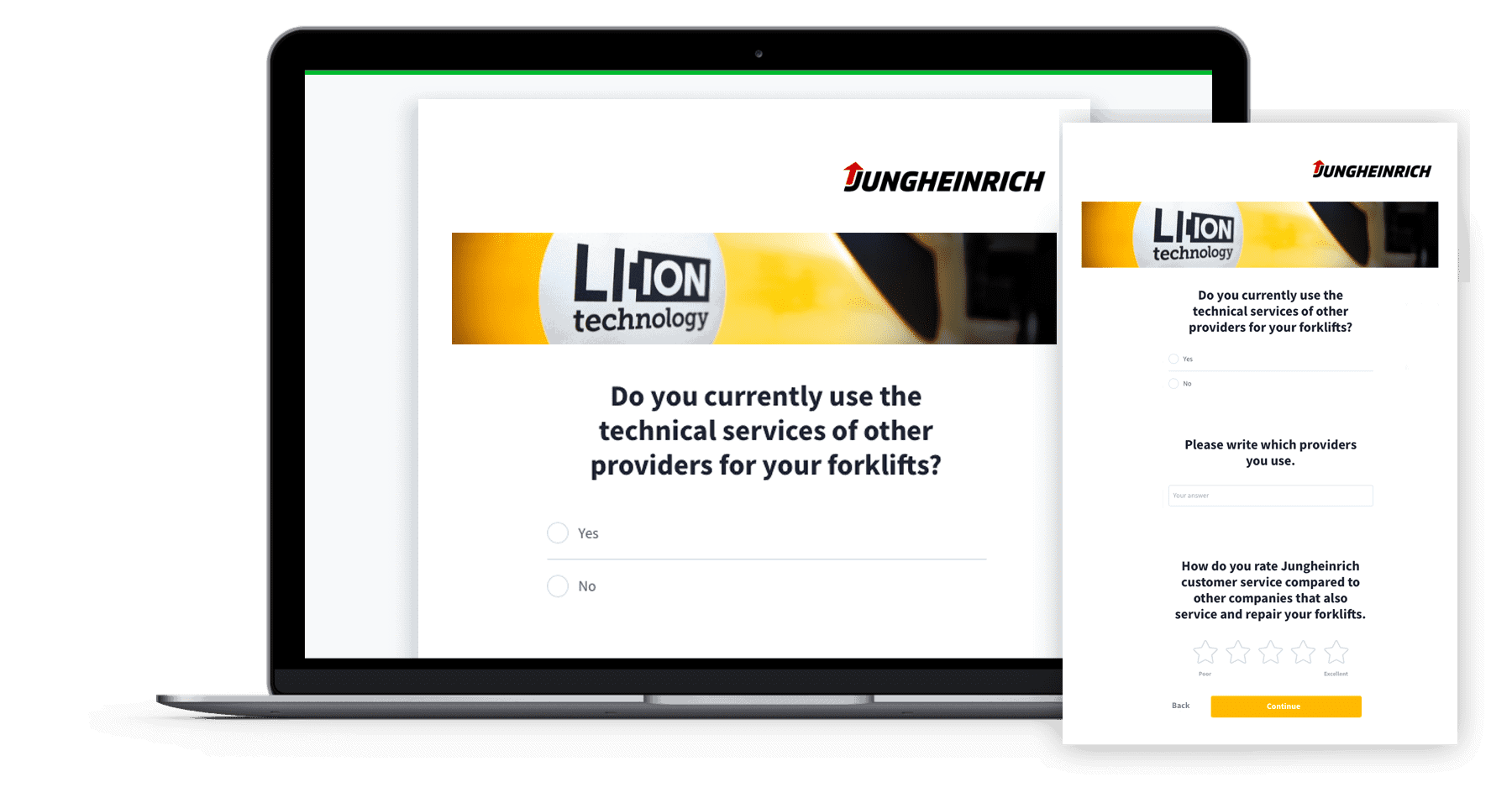

3. Jungheinrich: Relationship Survey

Jungheinrich is a global leading provider of intralogistics solutions. They understand the importance of building strong relationships with their customers and utilise surveys to uncover new revenue streams and upsell opportunities.

By asking the right questions in their relationship survey, the Slovak branch of Jungheinrich identified that 30% of their customers might be open to upselling. Armed with this knowledge, they can target their marketing activities accordingly, maximising revenue potential. This survey showcases how Jungheinrich leverages customer feedback to drive business growth and enhance its customer relationships.

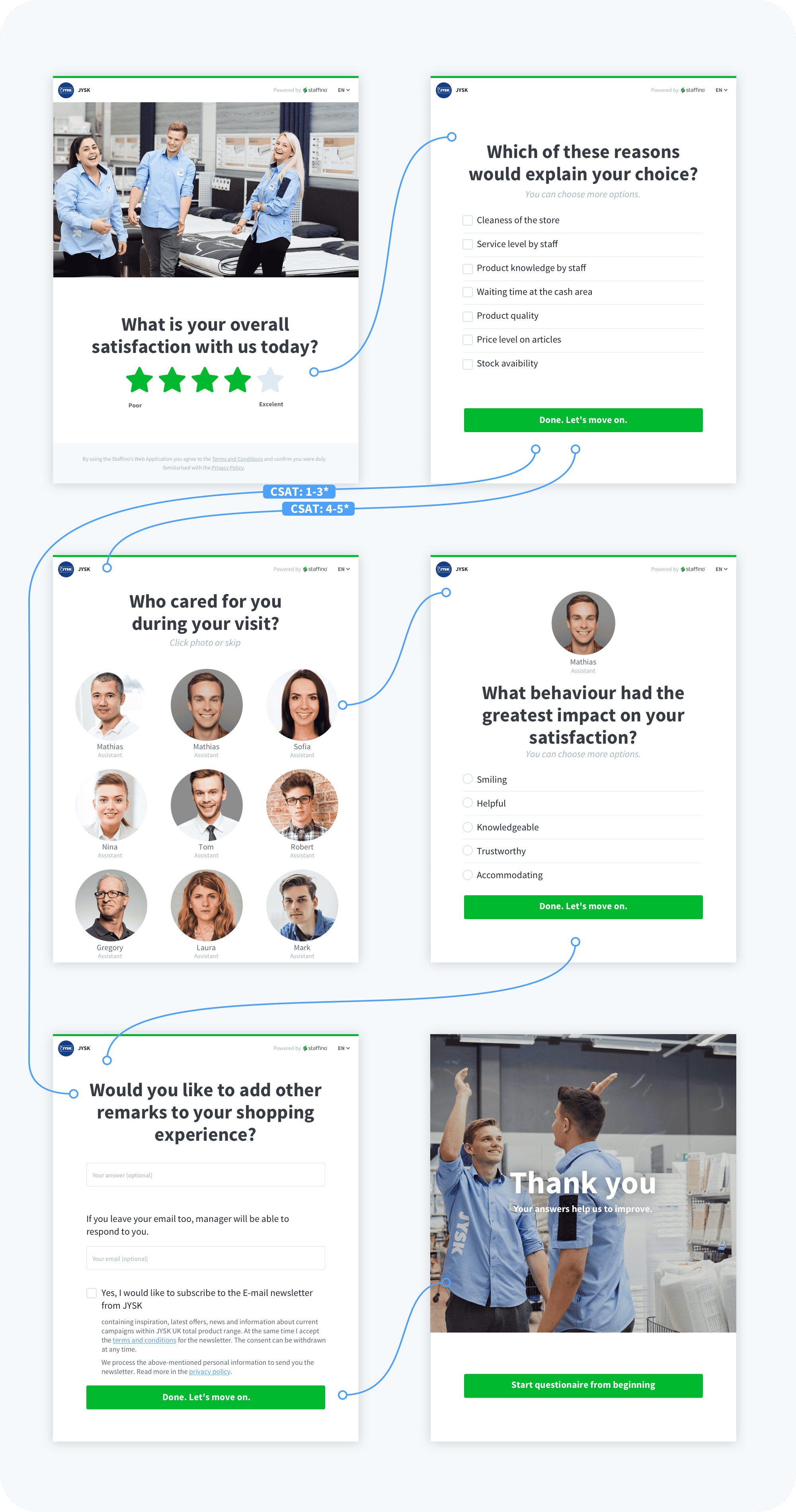

4. JYSK: Transactional CX Survey with Opt-In Subscription

JYSK is a global retail chain specialising in furniture and home goods. They utilise transactional CX surveys, combined with an opt-in subscription to their email newsletter, to collect feedback, as you can see in this customer feedback form example.

By using in-store kiosks to gather feedback, JYSK successfully collected over 340,000 email addresses in one year. This substantial email database translates to a significant lead value of €1.7 million, reflecting a robust return on their customer acquisition efforts. JYSK’s survey approach showcases how businesses can leverage customer feedback to not only enhance CX but also drive marketing and sales initiatives.

5. VSE: Touchpoint Survey with CES Metric

VSE is a leading Slovak energy distributor. They understand the importance of timely and clear customer support. By implementing a transactional survey, VSE measured the CES (Customer Effort Score) metric and the impact of response time on customer satisfaction.

Surprisingly, they found that clear and easily understandable answers were even more important than a short response time. Armed with this knowledge, VSE can train their support team accordingly, ensuring that their customers receive not only prompt but also comprehensive and easily understandable responses. This survey highlights the significance of understanding customer preferences and tailoring support strategies accordingly.

These five powerful client satisfaction survey examples from real brands demonstrate the effectiveness of utilising surveys to enhance CX strategies. Whether it is measuring satisfaction with delivery couriers, evaluating contact centre interactions, uncovering upsell opportunities, driving marketing initiatives, or understanding customer preferences, client surveys provide valuable insights that enable businesses to make data-driven decisions and deliver exceptional customer experiences.

Next Steps: Optimising Your Post-Survey Follow-Up Process

After conducting a customers satisfaction survey, the next crucial step is to optimise your post-survey follow-up process. This step is often overlooked, but it plays a significant role in leveraging the insights gathered from the survey to drive meaningful improvements in your customer experience.

One of the most critical aspects of optimising your post-survey follow-up process is the analysis of the collected insights. It is not enough to simply collect the cx feedback; you must extract valuable information from it. Just as the companies mentioned in the questionnaire examples above have successfully utilised survey data to make informed decisions, your organisation can also benefit from this practice.

To optimise your post-survey follow-up process, consider implementing the following steps:

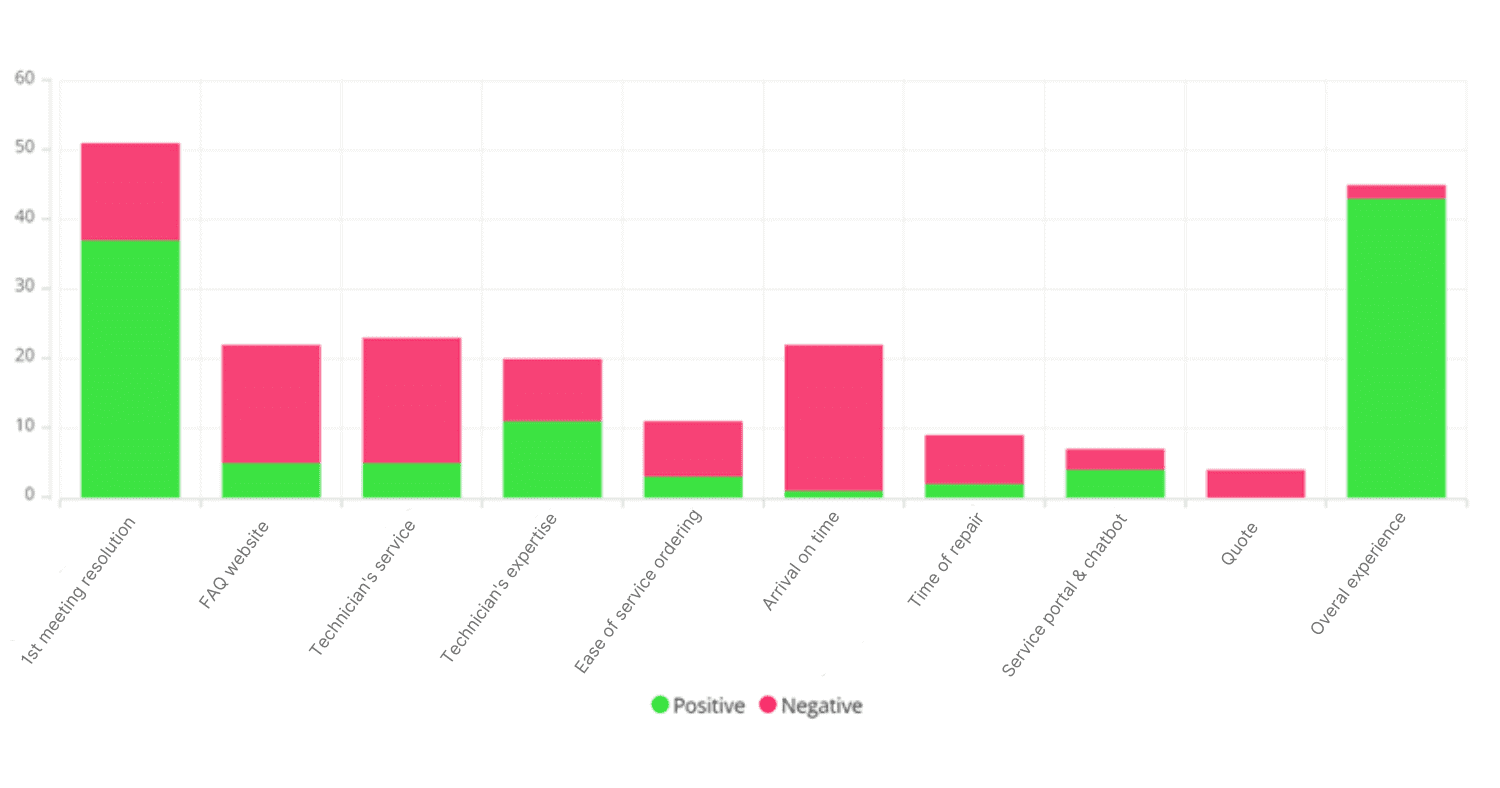

1. Review and categorise the feedback: Go through each response and categorise them based on themes or topics. This will help you identify common issues or patterns that need attention. Seems like a lot of work? We recommend using AI customer feedback analysis, which can swiftly analyse a vast amount of feedback and categorise it based on the most frequently mentioned positive and negative topics.

2. Prioritise action items: Rank the identified issues based on their impact on the overall customer experience. Focus on the areas that will have the most significant positive impact when improved.

3. Create an action plan: Develop a clear plan of action to address the identified issues. Assign responsibilities and set deadlines to ensure accountability.

4. Communicate with customers: Implement a closed loop feedback system. Reach out to customers who provided feedback and let them know that their voices have been heard. Inform them about the actions you are taking to address their concerns and thank them for their valuable input.

Get Actionable Insights with Closed Loop Feedback Management

With Staffino, you'll never leave a customer unhappy again! Streamline the process of collecting and responding to feedback, identify areas of improvement, and make sure that customer issues are addressed quickly and effectively.

5. Monitor progress: Continuously track the progress of the implemented changes and measure their impact on the customer experience. This will help you assess the effectiveness of your actions and make any necessary adjustments.

Remember, the true value of a CX survey lies in the insights it provides.

Simplifying CX Surveys Using a Customer Experience Management Platform

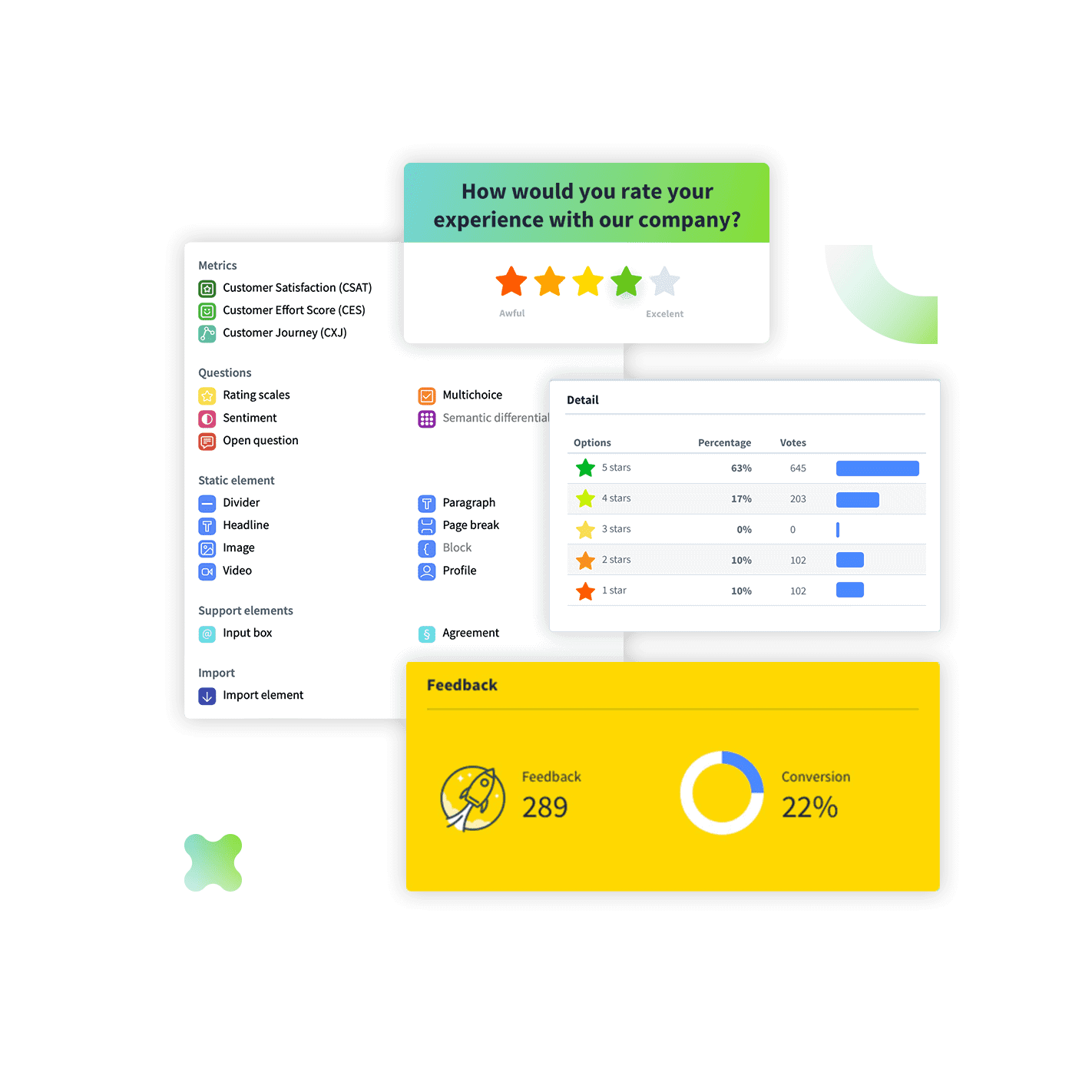

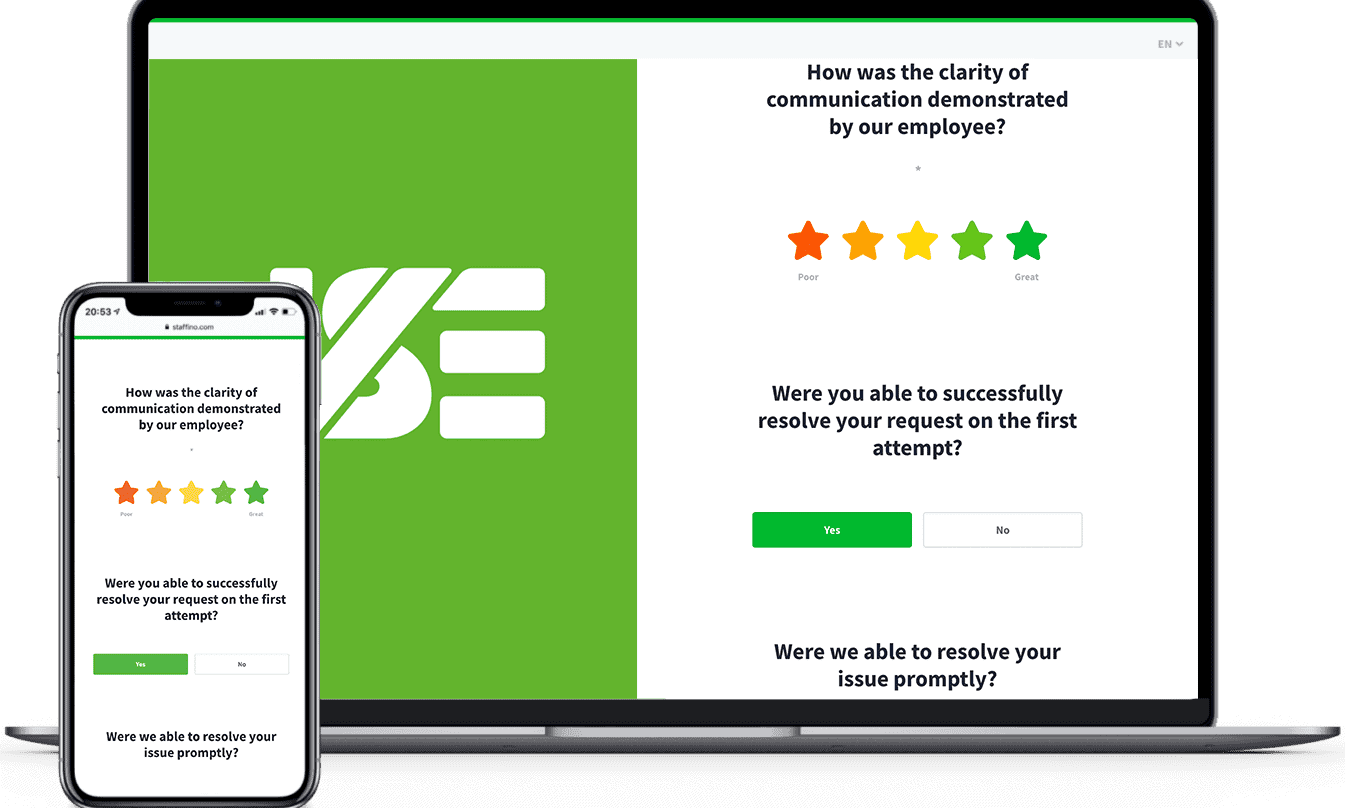

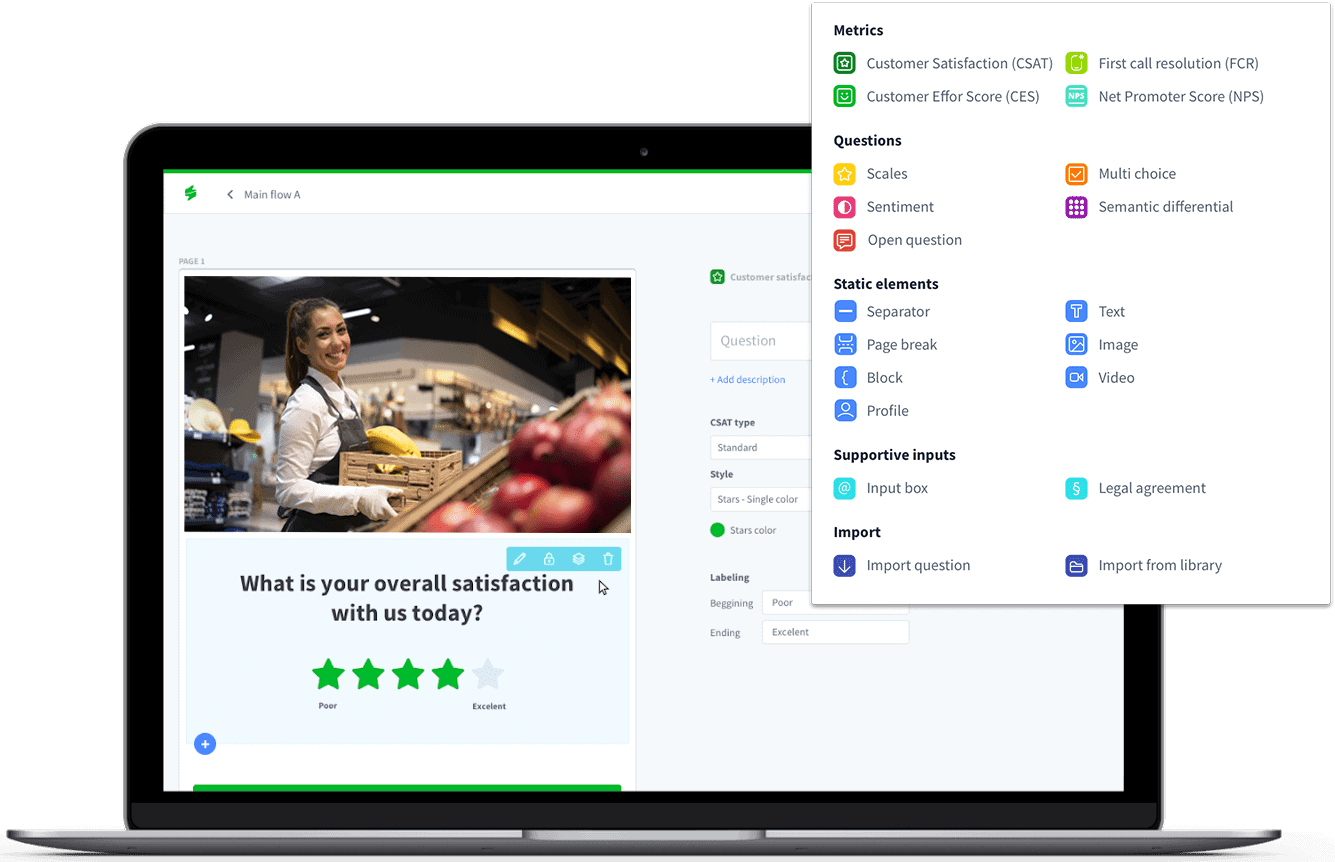

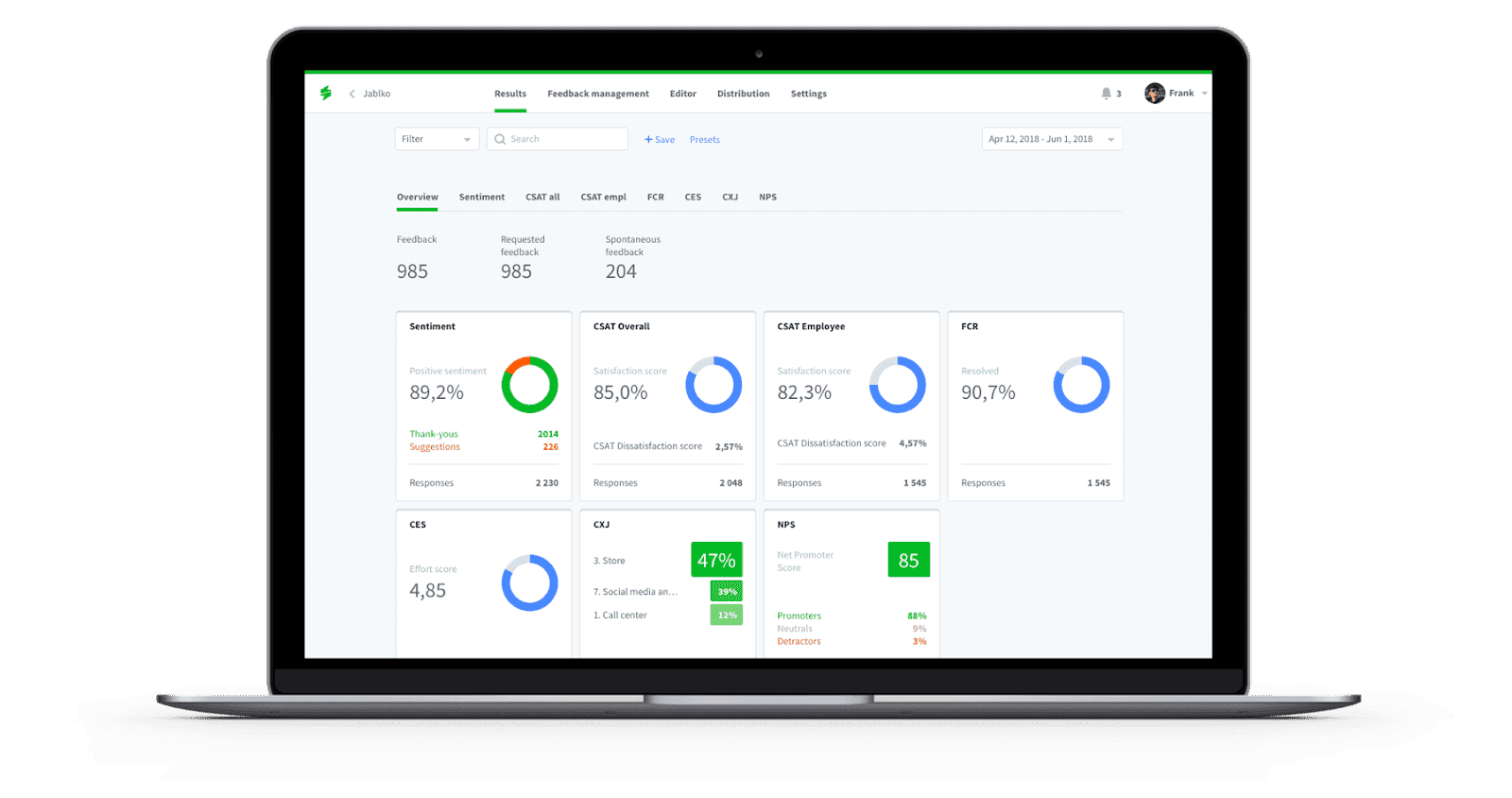

Designing and distributing CX feedback surveys can be a complex task, requiring the right tools and expertise. With Staffino, you can easily create customised surveys, distribute them through multiple channels, and analyse the results in real time.

Our customer experience management platform allows you to choose from a variety of question types, including multiple-choice, rating scales, and open-ended questions, giving you the flexibility to gather the information that is most important to your business. You can also add branding elements to your surveys, ensuring a consistent and professional look that aligns with your company’s image.

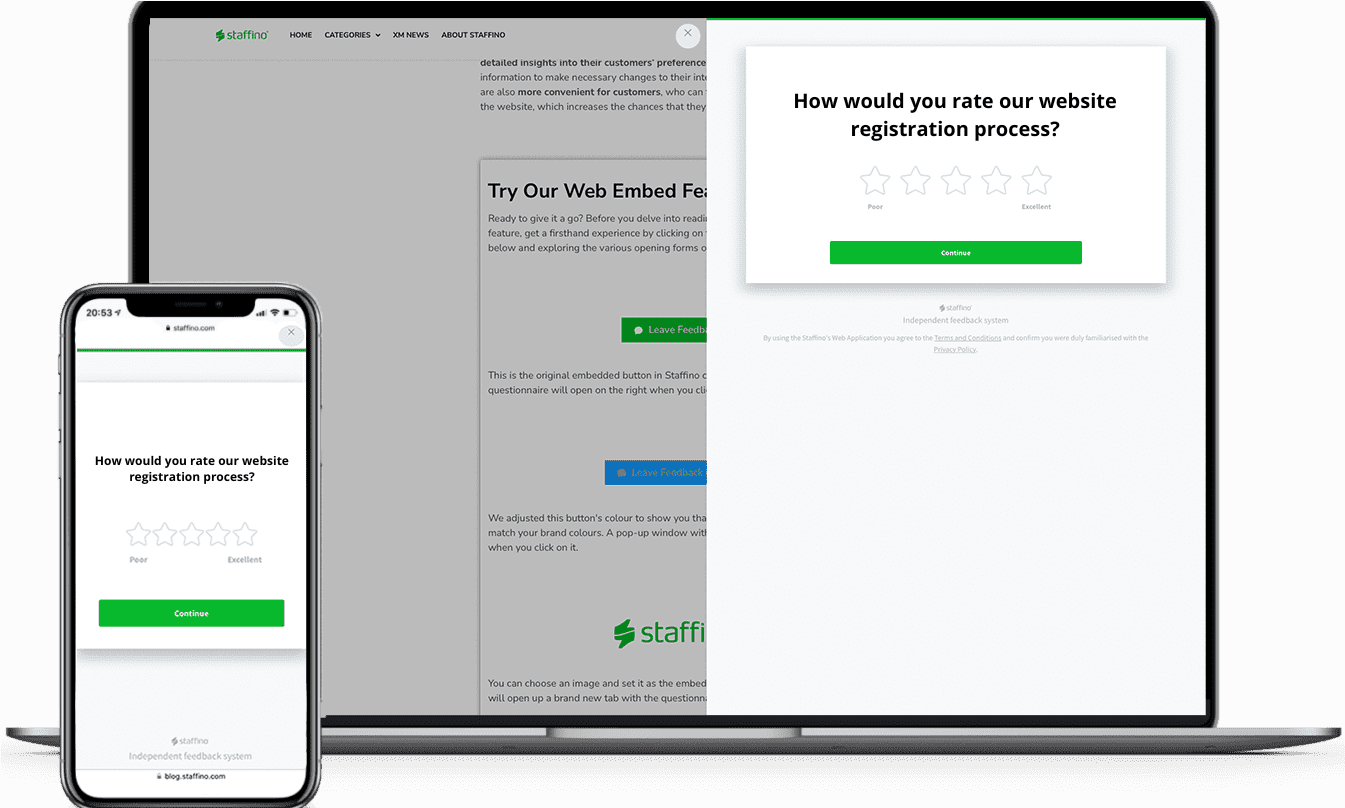

With Staffino’s multi-channel capabilities, distributing your surveys is a breeze. You can send surveys via email, SMS, messaging apps, or even create an embedded website survey. This ensures that you reach your customers through their preferred communication channels, increasing response rates and providing a seamless experience.

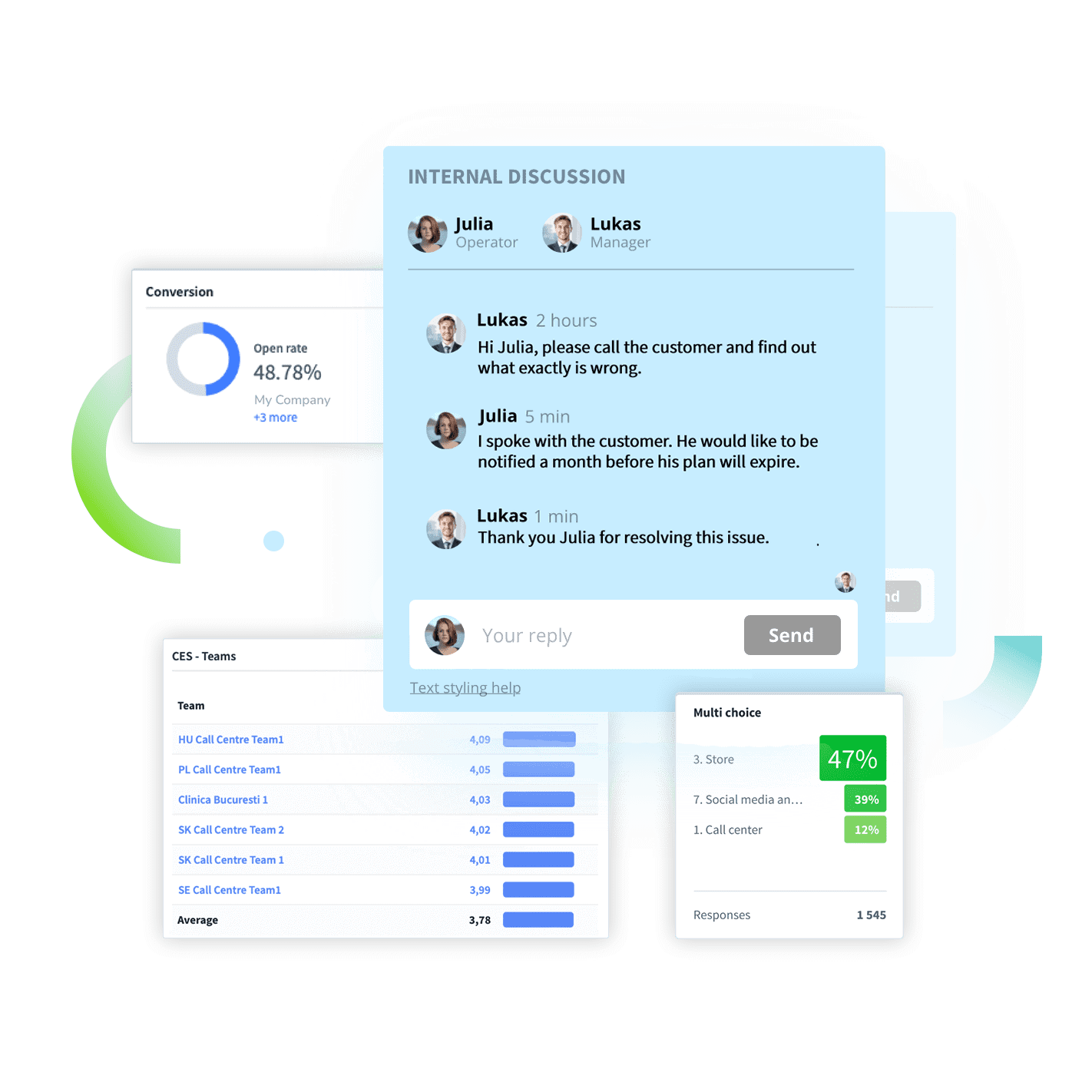

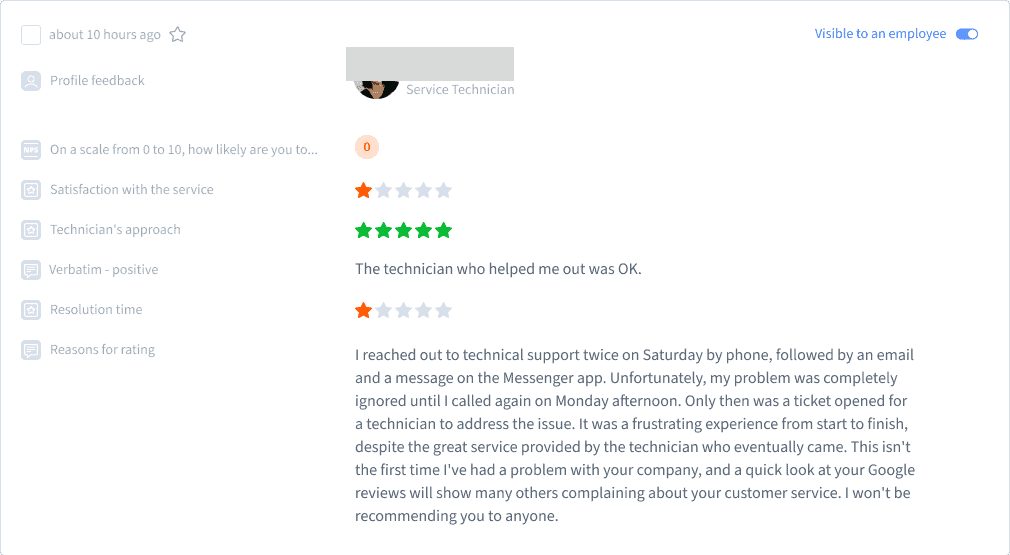

Once your surveys are in the hands of your customers, you can track responses as they come in, gaining immediate insights into customer sentiment and satisfaction levels. Our AI-powered customer experience dashboard provides visualisations and reports that make it easy to understand and interpret the data, allowing you to identify trends and areas for improvement.

In addition to its powerful survey capabilities, Staffino also offers seamless integration with other customer experience tools and systems, such as CRM and helpdesk software. By leveraging Staffino’s comprehensive features, you can gain valuable insights into your customer experience and make informed decisions to drive success.

Get Started with Our Online Customer Survey Creator Today!

With the assistance of the Staffino experience management platform, designing feedback survey questions and distributing CX surveys becomes a seamless process, enabling you to unlock the full potential of your customer experience strategies.

Schedule a free demo with our team to see how it works!

Get a First-Hand Experience Today!

Staffino is the perfect tool for creating engaging surveys, tracking performance, responding to customer feedback, and rewarding top employees. Get started today with our FREE demo!