As public reviews continue to shape the perception and performance of pharmacy chains, understanding what customers are truly saying becomes vital. That’s exactly where Staffino steps in. Harnessing the power of our advanced AI Public Reviews and Competition Analyser, we’ve conducted the largest analysis of pharmacy customer feedback in Poland to date.

We examined over 13,000 Google reviews across 12 leading pharmacy retail chains, helping us uncover unique trends, reveal competitive benchmarks, and offer actionable recommendations to elevate customer satisfaction and pharmacy performance. Let’s dive in!

13 Key Findings from the Polish Pharmacy Retail Market

1. Apteka Słoneczna Leads in Customer Satisfaction

In the competitive landscape of Polish pharmacy chains, Apteka Słoneczna emerged as the top performer with a 56.7% satisfaction rate. Close behind were Apteka od Serca at 55.5% and Apteka Niezapominajka with 48.8%. These chains consistently impressed customers with service quality, staff professionalism, and availability of products—setting a benchmark for others in the market.

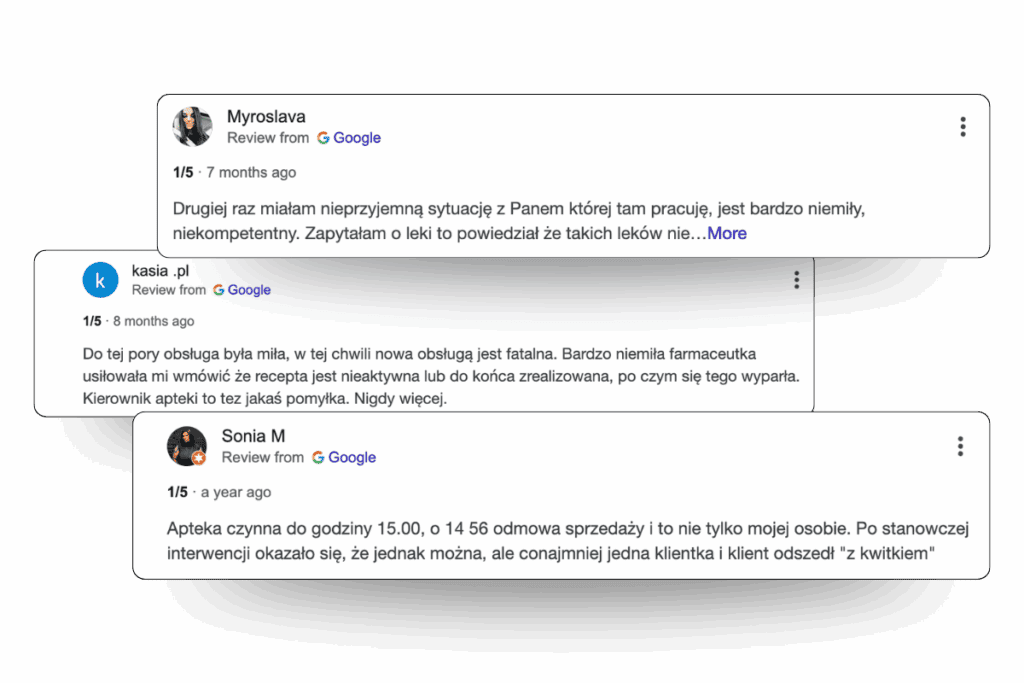

2. Apteka Cosmedica Faces the Biggest CX Challenges

At the other end of the spectrum, Apteka Cosmedica struggled the most with a negative satisfaction rate of -20.4%. This significant gap underscores serious issues in service delivery and suggests the need for urgent operational and CX-focused interventions to reverse customer dissatisfaction.

3. Big Cities, Bigger Frustrations

Interestingly, our data shows that the most negative reviews come from major cities like Warsaw, Kraków, and Wrocław. This may be attributed to the fast-paced urban lifestyle, higher customer expectations, and potentially overworked pharmacists with limited time to offer personalised service.

These findings highlight the need for tailored CX strategies in high-traffic metropolitan areas.

4. Employees Are the Stars of Polish Pharmacies

Polish customers consistently praised pharmacists, making employee performance the most positively discussed topic. Specifically, employee attitude scored 14.36%, and competence and helpfulness came in at 11.54%. Clearly, when it comes to pharmacy experiences, nothing matters more than friendly, knowledgeable employees.

5. But There’s Work to Be Done in Complaints and Accessibility

On the flip side, customers expressed the most dissatisfaction with complaint handling and resolution, which received a -5.05% sentiment score.

Issues related to product quality and safety, which scored -0.47% and service hours and accessibility, which scored -0.34%, also emerged as areas of concern. These represent critical opportunities for pharmacy chains to reassess internal processes and better meet customer needs.

6. Employee Interaction Dominates the Conversation

Out of all the reviews analysed, over 7,000 mentioned employees, confirming that pharmacist interactions are the cornerstone of customer satisfaction. Whether it’s a warm greeting or expert advice, the human element remains the most powerful driver of positive pharmacy experiences.

7. Gorzów Wielkopolski – Home to Poland’s Best Pharmacy Ratings

On a city level, Gorzów Wielkopolski stood out with the highest-rated pharmacies overall. This suggests that smaller or regional cities may offer a more consistent and personalised customer experience—something big city pharmacies can aim to replicate.

8. Highest Review Volume: Apteka Słoneczna, Gemini, and Dr. Max

When it comes to visibility and pharmacy customer engagement, Apteka Słoneczna led with 2,056 reviews, followed closely by Apteka Gemini (1,947 reviews) and Dr. Max (1,856 reviews).

This level of customer feedback presents both a challenge and an opportunity: the more reviews you receive, the greater the need for efficient CX management.

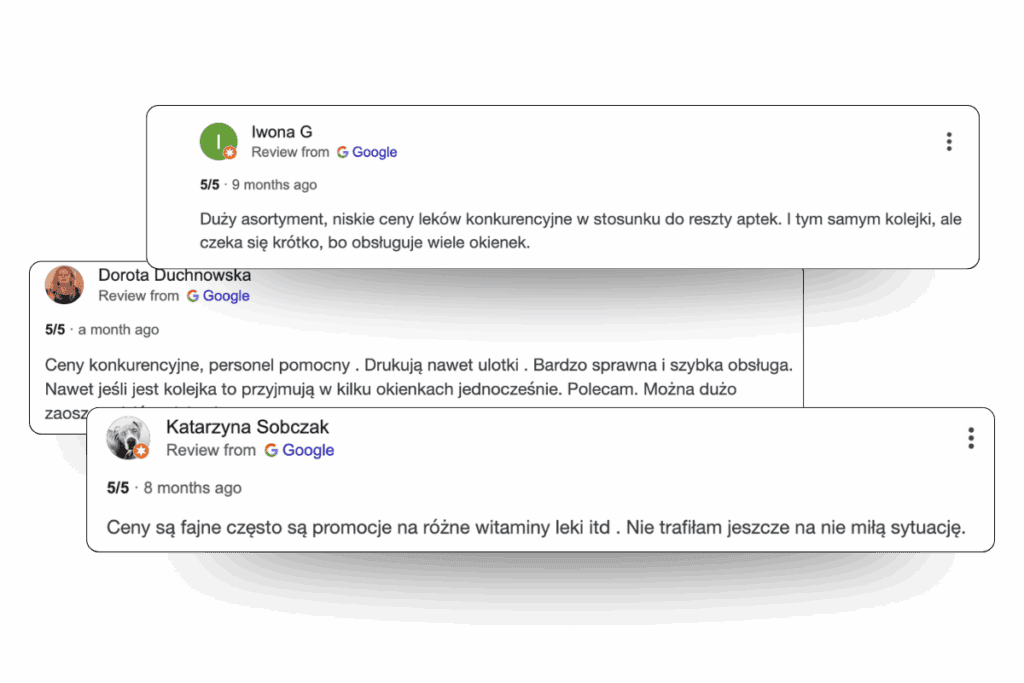

9. The Top 5 Most Common Reviews Say It All

The most frequently used phrases in Polish pharmacy reviews include:

- “Miła obsługa,”

- “Super obsługa,”

- “Bardzo miła obsługa,”

- “Polecam,”

- “Super apteka.”

These overwhelmingly positive phrases confirm that a warm, friendly approach is a winning formula in pharmacy retail.

10. Apteka od Serca Wins in Satisfaction with Employees, Dr Zdrowie Loses in Pricing

Drilling deeper, we found Apteka od Serca had the highest satisfaction with pharmacists, with the satisfaction rate of 24.04%.

On the other hand, Dr Zdrowie saw the most negative feedback around pricing and promotions, signalling a need for clearer value communication and competitive pricing strategies.

11. Warsaw’s Jurija Gagarina Branch Tops the Charts for Volume

The single most-reviewed pharmacy branch was DOZ — Warszawa, Jurija Gagarina 6, with 402 reviews on Google. This branch stands as a high-volume engagement point and a potential goldmine for learning about customer trends and expectations at the micro level.

12. Ziko Apteka Excels in Product Quality and Safety

For customers who value reliability and trust in their medications, Ziko Apteka came out on top with a 4.8% satisfaction score in the Product Quality & Safety category. This reinforces the importance of consistent quality control and safety standards across all branches.

13. Best Pharmacy Environments? Look No Further Than Dr Zdrowie

While Dr Zdrowie had challenges in pricing, it scored 100% in store environment satisfaction. Clean, well-organised, and comfortable spaces go a long way in making pharmacy visits more pleasant and stress-free.

Get the Full Analysis for Your Pharmacy!

These insights are just the tip of the iceberg. If you're eager to dive deeper into our findings or if you're looking for a more in-depth discussion tailored to your pharmacy chain, the Staffino team is here to help.

Our Methodology: AI-Driven Public Review Analysis

At the core of our research lies Staffino’s AI Public Reviews and Competition Analysis. This powerful tool scours and processes large volumes of publicly available reviews. For this analysis, we studied over 13,000 customer reviews across 12 major Polish pharmacy chains, making it the most comprehensive review-based CX study of its kind in the country.

Our AI analysis is built on a structured taxonomy of topics, such as pricing, staff attitude, or product quality. Each customer review can include multiple topics, and each “topic mention” receives either a positive or negative sentiment. For example, if a review comments on both pricing and staff helpfulness, it counts as two topic mentions.

To determine the impact of each topic on overall brand perception, we calculate a sentiment ratio: positive mentions minus negative mentions, divided by the total number of topic mentions across all topics. This approach ensures that a topic mentioned rarely (even if negatively) has less impact than a frequently discussed one. For instance, if all five mentions of store cleanliness are negative but most feedback focuses on price and staff, the impact of cleanliness remains minimal.

This ratio reveals which topics carry the most weight in shaping your brand’s image. It highlights what you should fix, promote, amplify, or monitor—based on what truly matters to your customers.

Want to Explore the Full Results?

These insights are just the beginning. If you want to benchmark your pharmacy chain against competitors, identify your biggest CX risks, or highlight your customer service strengths, Staffino’s AI-powered tools can deliver results that go beyond guesswork.

We’re ready to help you turn insights into action—and customer experience into competitive advantage.

Contact us today to access the full report or book a personalised consultation.