Complaint handling is broken. Pharmacists are under the spotlight. And Kaunas? Let’s just say customers there aren’t holding back. Welcome to the most honest report on Lithuanian pharmacies you’ll ever read.

While traditional customer surveys offer a snapshot, the real power lies in tapping into unsolicited, authentic feedback. That’s why we turned to public online reviews to deliver a data-backed analysis of pharmacy customer reviews in Lithuania. The goal? To uncover patterns in satisfaction and dissatisfaction, identify the best-performing chains, and highlight areas needing attention.

Using our AI Public Reviews & Competition Analysis, we processed nearly 1,000 Google reviews from customers across five major Lithuanian pharmacy chains. This marks the most extensive AI-based customer sentiment analysis in the Lithuanian pharmacy sector to date.

Key Insights from Lithuanian Pharmacy Customer Reviews

1. Gintarinė Vaistinė Takes the Crown for Customer Satisfaction

When it comes to winning over Lithuanian pharmacy customers, the pharmacy chain Gintarinė Vaistinė came out on top with a 27.9% satisfaction rate. Following in second and third place were Norfos Vaistinė (10.4%) and Camelia (7.5%), both showing solid performance. These chains were most often praised for their professional pharmacists and clean, welcoming environments.

2. Eurovaistinė Struggles with Customer Perception

On the opposite end, Eurovaistinė had the lowest satisfaction rating in the analysis, at -19%. This significant gap suggests that key areas like service consistency and responsiveness may be falling short of customer expectations.

3. Kaunas—A Hotspot for Negative Reviews

Interestingly, the bulk of negative sentiment originated from Kaunas, Lithuania’s second-largest city.

This aligns with trends we’ve observed in other markets, where larger urban areas with high foot traffic often suffer from rushed service and overburdened staff, leading to a drop in customer satisfaction.

4. People Appreciate Competent, Friendly Pharmacists and a Pleasant Atmosphere

Among the most positively discussed topics were pharmacist competence (7.01%), attitude (5.66%), and store environment (2.05%). Customers clearly value knowledgeable pharmacists who are both approachable and efficient—and they notice when pharmacy interiors are well-maintained and inviting.

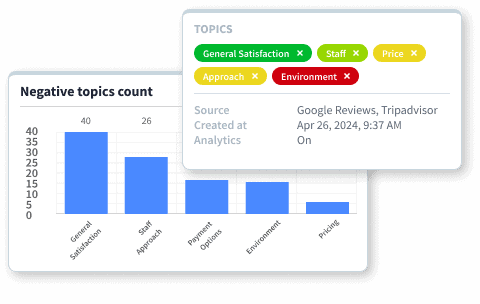

5. Complaint Handling and Waiting Times Are Major Pain Points

On the flip side, Lithuanian customers expressed the most dissatisfaction with complaint handling and resolution (-8.14%), service operating hours and accessibility (-2.21%), and service efficiency and waiting times (-1.3%). This points to a need for pharmacy chains to streamline internal processes, expand opening hours, and invest in customer service training to resolve issues more effectively.

6. Review Volume Highlights Popular Chains—and Problem Spots

The pharmacy chains with the most customer feedback were Eurovaistinė, Camelia, and Gintarinė Vaistinė, in this order.

The most-reviewed single branch was BENU Vaistinė on Žirmūnų g. 64 in Vilnius, with 149 reviews. Interestingly, BENU customers voiced strong dissatisfaction with complaint handling, scoring a -9.31% sentiment in this category.

7. Pharmacist Interactions Dominate the Feedback

A striking 80% of Eurovaistinė’s reviews focused on pharmacist-related topics—from attitude and professionalism to communication. This underscores how central pharmacists are to the pharma experience and how much they influence overall satisfaction.

8. Product Quality Isn’t on the Radar (Yet)

Curiously, product quality and safety barely registered in Lithuania, with only 20 mentions across all customer feedback. This may indicate high trust in product standards or that customers are more focused on human interaction and service than product concerns.

Our Approach: Structured Topic & Sentiment Analysis with AI

Each review was dissected by our AI engine using a structured framework of pharmacy-related customer experience topics, such as employee behaviour, waiting times, pricing, and complaint resolution. Instead of looking at each review as a whole, our CX platform identifies multiple “experience drivers” within a single comment—each referred to as a topic mention. Every mention is then categorised as either positive or negative, providing granular insights into what customers specifically like or dislike.

To assess the overall impact of each topic on pharmacy reputation, we applied a sentiment weighting model. This model considers both the number of mentions a topic receives and the balance of positive vs. negative sentiment. This gives us a realistic view of which aspects matter most to customers—and which influence brand perception the most, either positively or negatively.

Ready to Benchmark Your Pharmacy CX Performance?

The Lithuanian pharmacy market, while smaller in review volume, reveals clear CX priorities: well-trained, kind employees and efficient customer service. Pharmacies that fall short in these areas—especially in high-traffic cities—risk damaging their reputation.

If you’d like to dive deeper into how your chain compares or explore tailored recommendations based on this data, our AI Public Reviews & Competition Analyser can deliver the insights you need to grow.

Get in touch with the Staffino team and start transforming your pharmacy customer experience.

Get a First-Hand Experience Today!

Staffino is the perfect tool for creating engaging surveys, tracking performance, responding to customer feedback, and rewarding top employees. Get started today with our FREE demo!